Question: Your case study needs to identify and discuss the tax implications of the various issues raised. A report (word document, approx. 2,000 words) must be

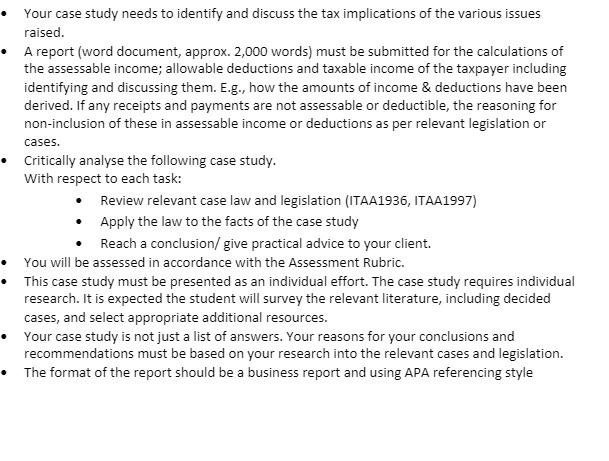

Your case study needs to identify and discuss the tax implications of the various issues raised. A report (word document, approx. 2,000 words) must be submitted for the calculations of the assessable income; allowable deductions and taxable income of the taxpayer including identifying and discussing them. E.g., how the amounts of income & deductions have been derived. If any receipts and payments are not assessable or deductible, the reasoning for non-inclusion of these in assessable income or deductions as per relevant legislation or cases. Critically analyse the following case study. With respect to each task: Review relevant case law and legislation (ITAA1936, ITAA1997) Apply the law to the facts of the case study Reach a conclusion/ give practical advice to your client. You will be assessed in accordance with the Assessment Rubric. This case study must be presented as an individual effort. The case study requires individual research. It is expected the student will survey the relevant literature, including decided cases, and select appropriate additional resources. Your case study is not just a list of answers. Your reasons for your conclusions and recommendations must be based on your research into the relevant cases and legislation. The format of the report should be a business report and using APA referencing style

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts