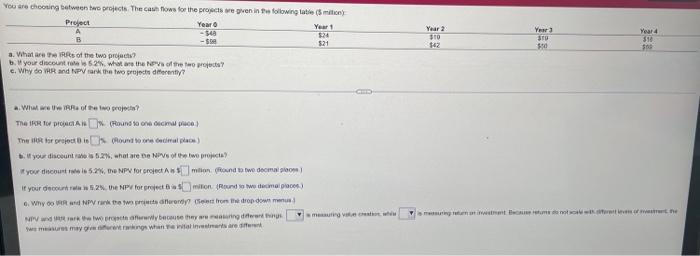

Question: Your choosing between two projects. The cash flows for the projects wegen in the following table in Project Year o Yew - 54 124 521

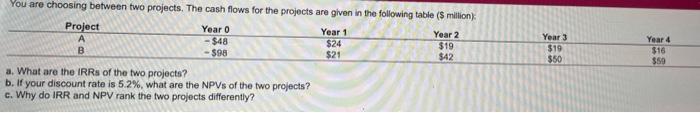

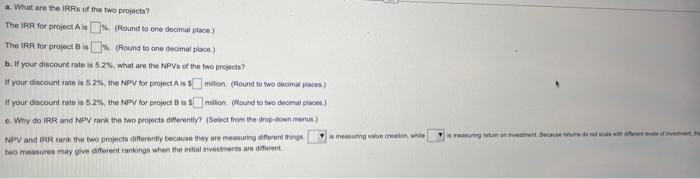

Your choosing between two projects. The cash flows for the projects wegen in the following table in Project Year o Yew - 54 124 521 3. What To Rs of the two project? b. your discount 52. What the of the words c. Why do Rand Park the two projets diferently Year 2 STO $42 Years STO Year 4 392 G a. We of the prope? The Top IX Round so ona ich praca The stor pris undone and place) your discountwhat are De NPV the two project your doctel 5.2%, the NPV for resten and we decom if your chesthe NPV for projection Roundwo decimal places) Why dronk that thered on the dropdown NP w wore after because they were mig varstw may ring when waters are different You are choosing between two projects. The cash flows for the projects are given in the following table ($ million) Project Year 0 Year 1 Year 2 - $48 $24 $19 B -$98 $21 $42 Year 3 $19 $50 Year 4 $16 $50 a. What are the IRRs of the two projects? b. If your discount rate is 5.2%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects The IRR for project Ais I) (Round to one decimal place) The IRR for project is (Round to one decimal place) b. If your discount rate is 32%, what are the NPV of the two projects? if your discount rate : 6.2%, the NPV for project is ition (Round to two decimal places) if your discount rates 5.2, the NPV for project la milon (Pound to bwo decimal places c. Why do IRR and NPV rank the two projects diferently? (Select from the drop-dows maturing a creation while NPV and IRR rank the two projects differently because they are measuring different things two measures may give different rankings when the initial investments are different monet chrome

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts