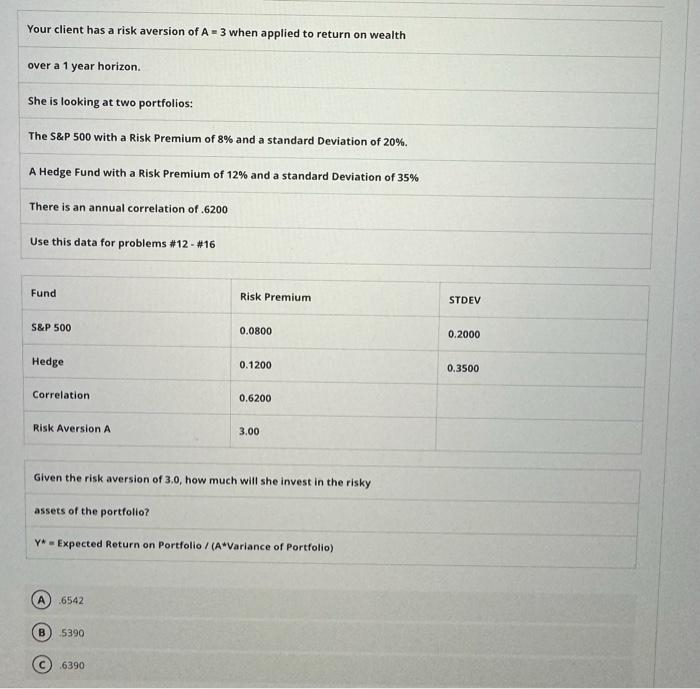

Question: Your client has a risk aversion of A 3 when applied to return on wealth over a 1 year horizon. She is looking at

Your client has a risk aversion of A 3 when applied to return on wealth over a 1 year horizon. She is looking at two portfolios: The S&P 500 with a Risk Premium of 8% and a standard Deviation of 20%. A Hedge Fund with a Risk Premium of 12% and a standard Deviation of 35% There is an annual correlation of .6200 Use this data for problems #12 - #16 Fund S&P 500 Hedge Correlation Risk Aversion A Risk Premium STDEV 0.0800 0.1200 0.6200 3.00 Given the risk aversion of 3.0, how much will she invest in the risky assets of the portfolio? Y* Expected Return on Portfolio / (A*Variance of Portfolio) .6542 5390 .6390 0.2000 0.3500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts