Question: Your client has stated that his annual return requirement is Inflation 2 % ( before tax ) . In terms of risk tolerance, he wants

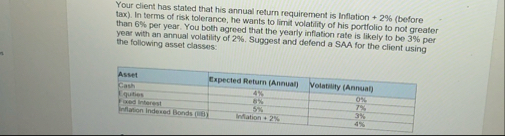

Your client has stated that his annual return requirement is Inflation before tax In terms of risk tolerance, he wants to limit volatility of his portfolio to not greater than per year You both agreed that the yearly inflation rate is likely to be per year with an annual volatility of Suggest and defend a SAA for the client using the following asset classes:

tableAssetExpected Return AnnualVolatility Annual quities,Fixed Interest,Inflation Indered Bonds Inflation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock