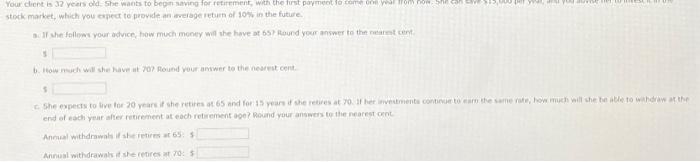

Question: Your client is 32 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can

stock market, which you espect to provide an average return of 10% in the futire. a. If she fallews your advice, how much money will whe have at 65) Round yoer answer to the rearmt cert. 5 s 6. How noch will she have it 70? found wour amwer to the nesest cert. 5 end of each year after revirement at each retirement oge? Round your ansens to the nearest cent Anrival withdrawals if ahe ietires at 65 ; 5 Arinusl withdrawah id she renires at 70:5 stockmarket; which you expect to providn ao average return of 10% in the future. a. If she follows your advice, how much money will she have at 65?. Round your asswer to the nearest cert 5 b. Haw much will ahe have at 70 ? Rocind vour answer to the nearest cent. 1 Ahinobl watdrawals af ahe rebires at 65 : 1 Arnual watudrawals if the retires as 70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts