Question: Your client is a 30 year-old, married professional with a combined household income of $250,000/yr. The client and their spouse have committed to saving 10

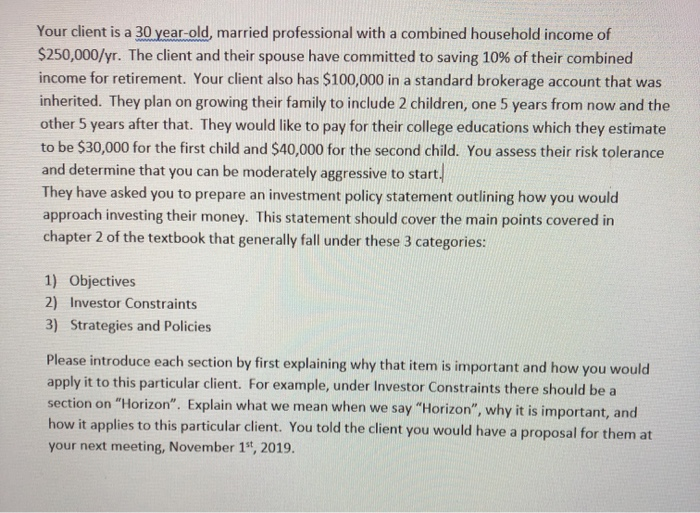

Your client is a 30 year-old, married professional with a combined household income of $250,000/yr. The client and their spouse have committed to saving 10 % of their combined income for retirement. Your client also has $100,000 in a standard brokerage account that was inherited. They plan on growing their family to include 2 children, one 5 years from now and the other 5 years after that. They would like to pay for their college educations which they estimate to be $30,000 for the first child and $40,000 for the second child. You assess their risk tolerance and determine that you can be moderately aggressive to start They have asked you to prepare an investment policy statement outlining how you would approach investing their money. This statement should cover the main points covered in chapter 2 of the textbook that generally fall under these 3 categories: 1) Objectives 2) Investor Constraints 3) Strategies and Policies Please introduce each section by first explaining why that item is important and how you would apply it to this particular client. For example, under Investor Constraints there should be a section on "Horizon". Explain what we mean when we say "Horizon", why it is important, and how it applies to this particular client. You told the client you would have a proposal for them at your next meeting, November 1st, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts