Question: Your client observes the following two benchmark spreads for two bonds: Bond issue U rated A:150 basis points Bond issue V rated BBB: 135 basis

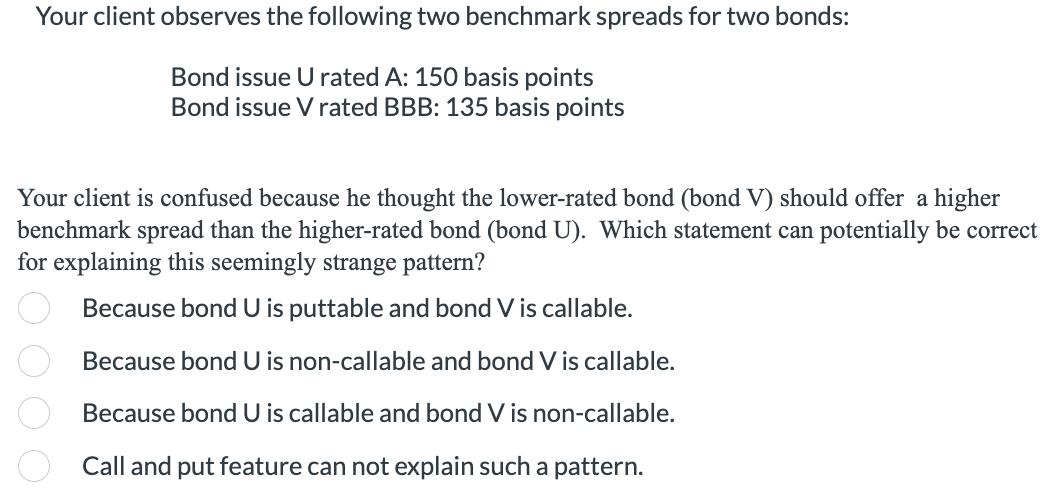

Your client observes the following two benchmark spreads for two bonds: Bond issue U rated A:150 basis points Bond issue V rated BBB: 135 basis points Your client is confused because he thought the lower-rated bond (bond V) should offer a higher benchmark spread than the higher-rated bond (bond U). Which statement can potentially be correct for explaining this seemingly strange pattern? Because bond U is puttable and bond V is callable. Because bond U is non-callable and bond V is callable. Because bond U is callable and bond V is non-callable. Call and put feature can not explain such a pattern

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts