Question: Your company develops and distributes new application software for local computer distributors. Initially, the company has been operating in the northern region, but due

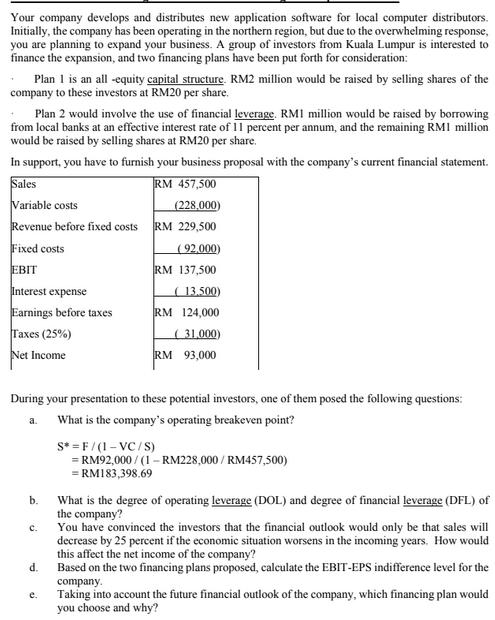

Your company develops and distributes new application software for local computer distributors. Initially, the company has been operating in the northern region, but due to the overwhelming response, you are planning to expand your business. A group of investors from Kuala Lumpur is interested to finance the expansion, and two financing plans have been put forth for consideration: Plan 1 is an all-equity capital structure. RM2 million would be raised by selling shares of the company to these investors at RM20 per share. Plan 2 would involve the use of financial leverage, RMI million would be raised by borrowing from local banks at an effective interest rate of 11 percent per annum, and the remaining RMI million would be raised by selling shares at RM20 per share. In support, you have to furnish your business proposal with the company's current financial statement. Sales Variable costs Revenue before fixed costs RM 457,500 (228,000) RM 229,500 Fixed costs (92,000) EBIT RM 137,500 Interest expense 13.500) Earnings before taxes RM 124,000 Taxes (25%) (31,000) Net Income RM 93,000 During your presentation to these potential investors, one of them posed the following questions: a. What is the company's operating breakeven point? b. C. d. e. S* F/(1-VC/S) = RM92,000/(1 - RM228,000/RM457,500) = RM183,398.69 What is the degree of operating leverage (DOL) and degree of financial leverage (DFL) of the company? You have convinced the investors that the financial outlook would only be that sales will decrease by 25 percent if the economic situation worsens in the incoming years. How would this affect the net income of the company? Based on the two financing plans proposed, calculate the EBIT-EPS indifference level for the company. Taking into account the future financial outlook of the company, which financing plan would you choose and why?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts