Question: Your company has set up a US$ commercial paper program in the amount of $75 million U.S. and is turning it over every 30

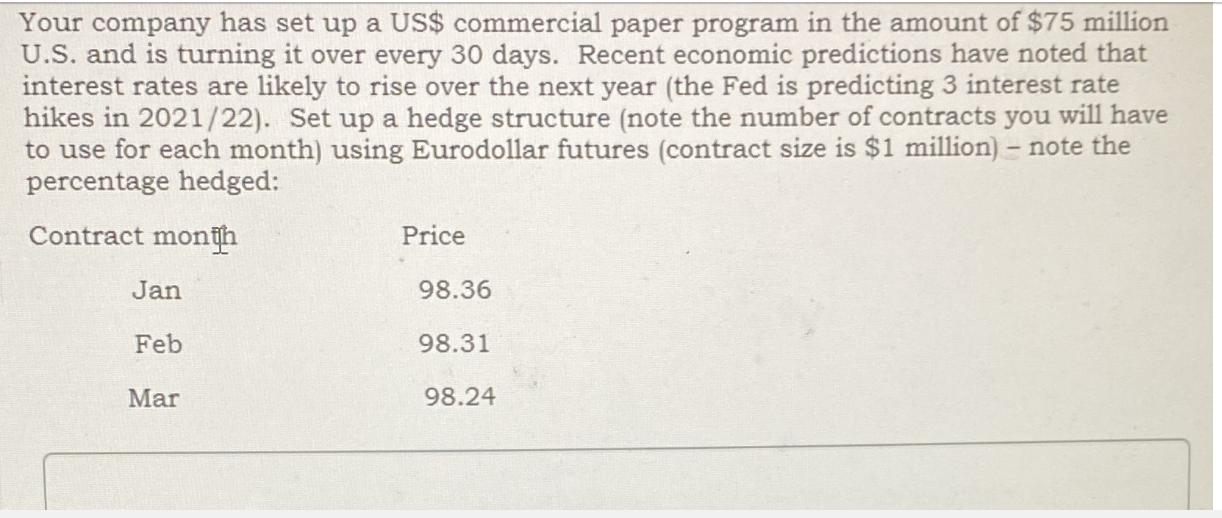

Your company has set up a US$ commercial paper program in the amount of $75 million U.S. and is turning it over every 30 days. Recent economic predictions have noted that interest rates are likely to rise over the next year (the Fed is predicting 3 interest rate hikes in 2021/22). Set up a hedge structure (note the number of contracts you will have to use for each month) using Eurodollar futures (contract size is $1 million) - note the percentage hedged: Contract month Jan Feb Mar Price 98.36 98.31 98.24

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

To hedge against the interest rate risk you can use Eurodollar futures contracts Since your commerci... View full answer

Get step-by-step solutions from verified subject matter experts