Question: Your company is considering a project that requires an initial investment of $15 million, and is expected to produce cash flows of $4 million each

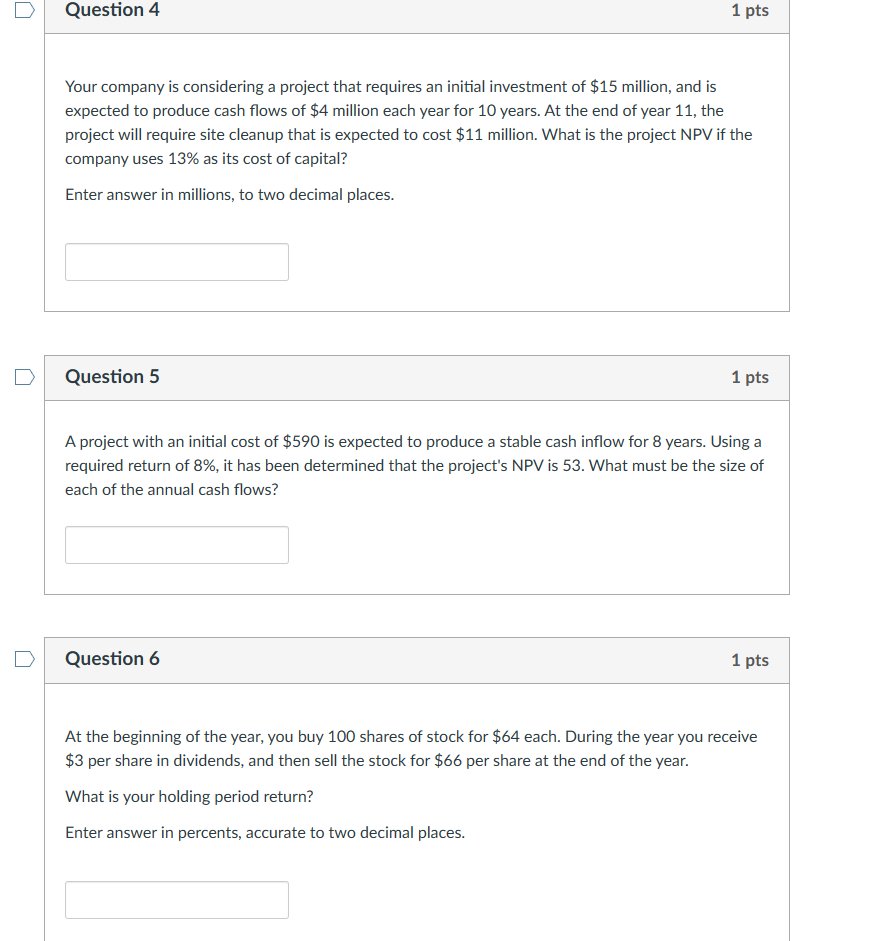

Your company is considering a project that requires an initial investment of $15 million, and is expected to produce cash flows of $4 million each year for 10 years. At the end of year 11 , the project will require site cleanup that is expected to cost $11 million. What is the project NPV if the company uses 13% as its cost of capital? Enter answer in millions, to two decimal places. Question 5 1 pts A project with an initial cost of $590 is expected to produce a stable cash inflow for 8 years. Using a required return of 8%, it has been determined that the project's NPV is 53 . What must be the size of each of the annual cash flows? Question 6 1 pts At the beginning of the year, you buy 100 shares of stock for $64 each. During the year you receive $3 per share in dividends, and then sell the stock for $66 per share at the end of the year. What is your holding period return? Enter answer in percents, accurate to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts