Question: Your company is considering producing a virtual reality headset, for which you've collected the following sales projections (in $ million). Operating expenses are expected to

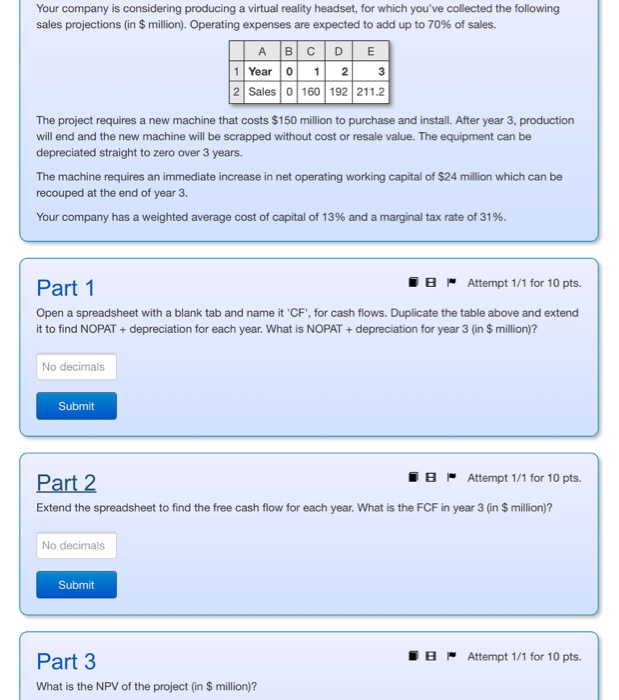

Your company is considering producing a virtual reality headset, for which you've collected the following sales projections (in $ million). Operating expenses are expected to add up to 70% of sales. A |B| C | D | E 1 Year0 1 23 2 Sales 0 160 192 211.2 The project requires a new machine that costs $150 million to purchase and install. After year 3, production will end and the new machine will be scrapped without cost or resale value. The equipment can be depreciated straight to zero over 3 years. The machine requires an immediate increase in net operating working capital of $24 million which can be recouped at the end of year 3. Your company has a weighted average cost of capital of 13% and a marginal tax rate of 31%. Part 1 Open a spreadsheet with a blank tab and name it 'CF', for cash flows. Duplicate the table above and extend it to find NOPAT+depreciation for each year. What is NOPAT+depreciation for year 3 (in $ million)? B Attempt 1/1 for 10 pts. No decimals Submit 8 Attempt 1 /1 for 10 pts. Part 2 Extend the spreadsheet to find the free cash flow for each year. What is the FCF in year 3 (in $ million)? No decimals Submit Part 3 What is the NPV of the project (in $ million)? B Attempt 1/1 for 10 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts