Question: Your company is considering taking on a new project that will require spending $200,000 on a new machine at Year 0. The project will increase

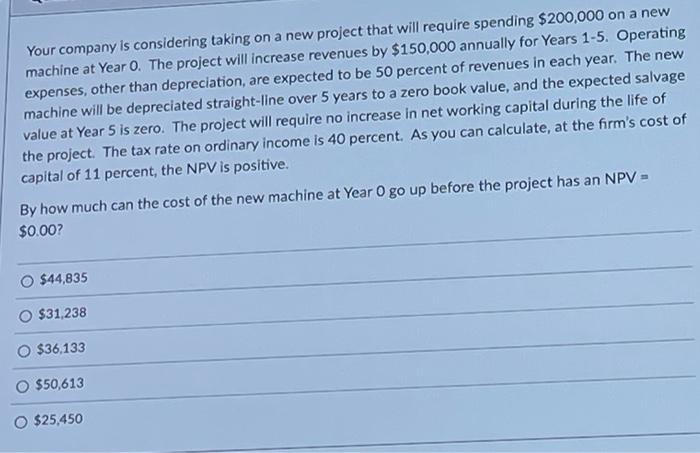

Your company is considering taking on a new project that will require spending $200,000 on a new machine at Year 0. The project will increase revenues by $150,000 annually for Years 1-5. Operating expenses, other than depreciation, are expected to be 50 percent of revenues in each year. The new machine will be depreciated straight-line over 5 years to a zero book value, and the expected salvage value at Year 5 is zero. The project will require no increase in net working capital during the life of the project. The tax rate on ordinary income is 40 percent. As you can calculate, at the firm's cost of capital of 11 percent, the NPV is positive. By how much can the cost of the new machine at Year 0 go up before the project has an NPV = $0.00? \begin{tabular}{|c|} \hline$44,835 \\ \hline$31,238 \\ \hline$36,133 \\ \hline$50,613 \\ \hline$25,450 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts