Question: Your company is considering two mutually exclusive projects, A and B , whose costs and cash flows are shown below. Project A is of average

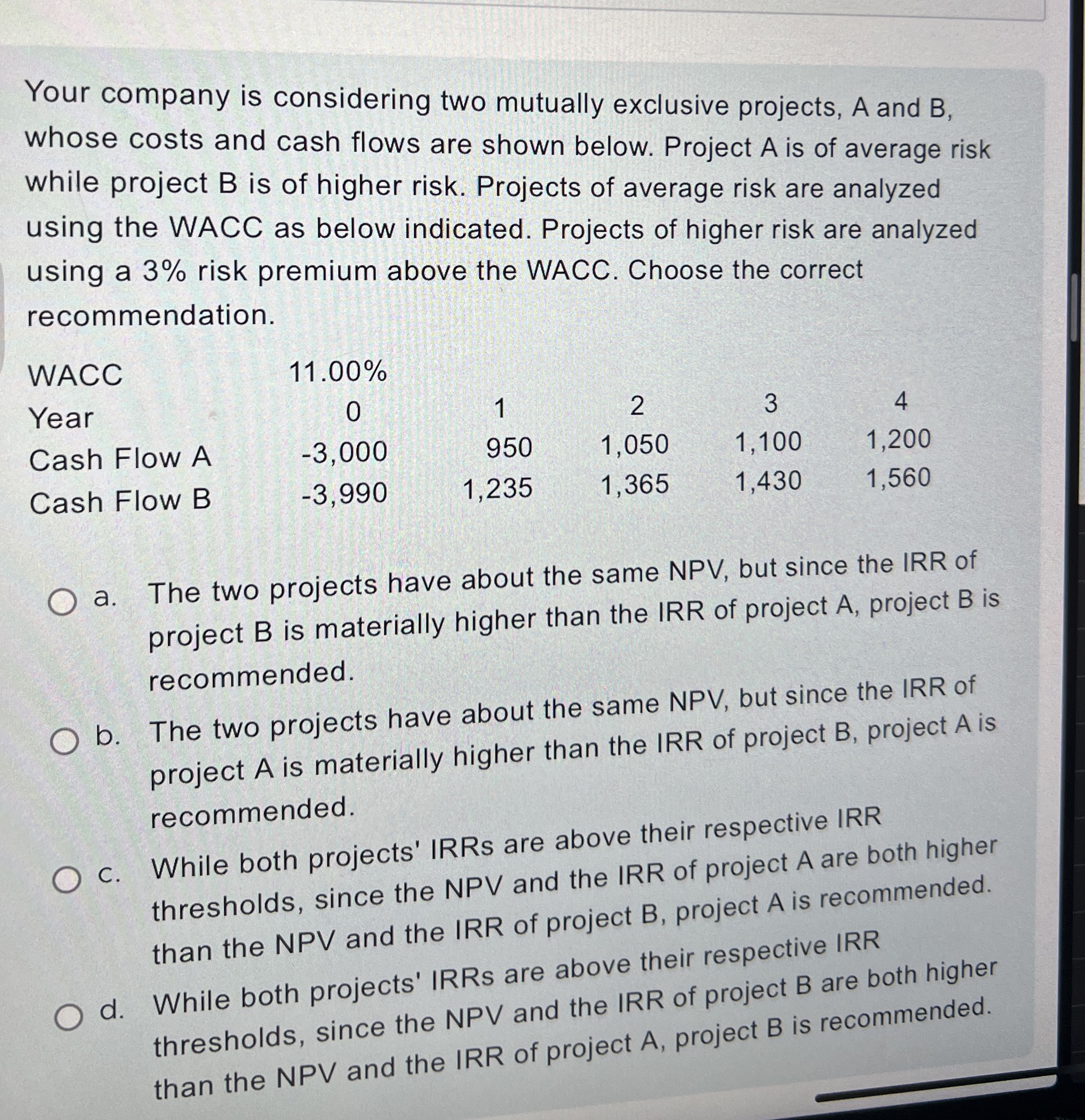

Your company is considering two mutually exclusive projects, A and whose costs and cash flows are shown below. Project is of average risk while project is of higher risk. Projects of average risk are analyzed using the WACC as below indicated. Projects of higher risk are analyzed using a risk premium above the WACC. Choose the correct recommendation.

tableWACCYearCash Flow ACash Flow B

a The two projects have about the same NPV but since the IRR of project is materially higher than the IRR of project project is recommended.

b The two projects have about the same NPV but since the IRR of project is materially higher than the IRR of project project is recommended.

C While both projects' IRRs are above their respective IRR thresholds, since the NPV and the IRR of project A are both higher than the NPV and the IRR of project B project is recommended.

d While both projects' IRRs are above their respective IRR thresholds, since the NPV and the IRR of project are both higher than the NPV and the IRR of project project is recommended.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock