Question: Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below. The projects are equally risky, and

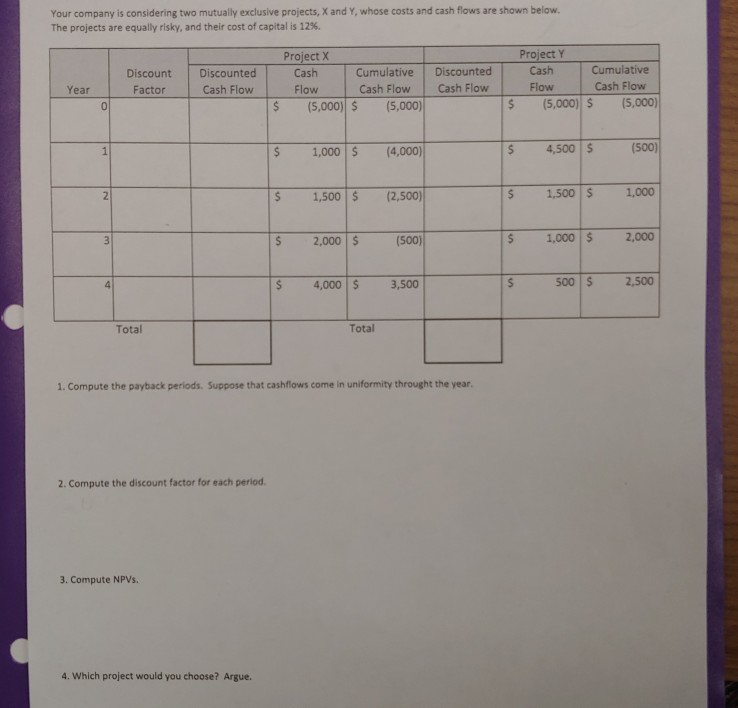

Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below. The projects are equally risky, and their cost of capital is 12% Project X Project Y Discount Discounted Cash Cumulative Discounted Cash Cumulative Cash Flovw Year Factor Cash Flow Flow Cash Flow Cash Flow Flow $ (5,000) (5,000) $ (5,000) (5,000) $ 1,000 (4,000) $ 1,500 (2,500) $ 2,000 $ 4,000$ 3,500 S 4,500 (500) $ 1,500 $ 1,000 (500) 1,000 2,000 500$ 2,500 Total Total 1. Compute the payback periods. Suppose that cashflows come in uniformity throught the year. 2. Compute the discount factor for each period 3. Compute NPVs 4. Which project would you choose? Argue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts