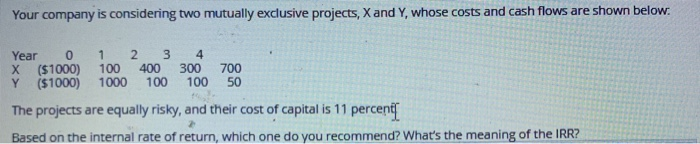

Question: Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below. Year 0 1 2 3 4

Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below. Year 0 1 2 3 4 X ($1000) 100 400 300 700 Y (51000) 1000 100 100 50 The projects are equally risky, and their cost of capital is 11 percent Based on the internal rate of return, which one do you recommend? What's the meaning of the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts