Question: Your company needs a machine for the next 20 years. You are considering two different machines. Machine A Installation cost ($): 2,000,000 Annual O&M costs

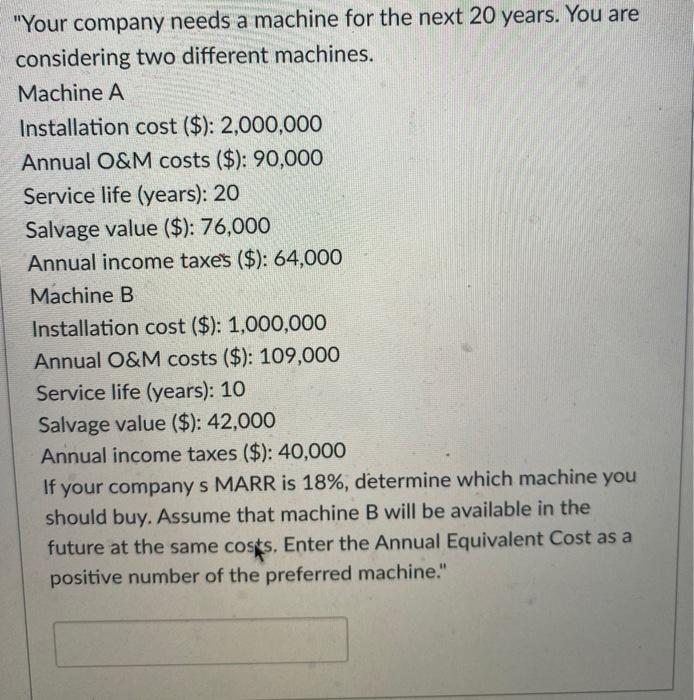

"Your company needs a machine for the next 20 years. You are considering two different machines. Machine A Installation cost ($): 2,000,000 Annual O&M costs ($): 90,000 Service life (years): 20 Salvage value ($): 76,000 Annual income taxe's ($): 64,000 Machine B Installation cost ($): 1,000,000 Annual O&M costs ($): 109,000 Service life (years): 10 Salvage value ($): 42,000 Annual income taxes ($): 40,000 If your company s MARR is 18%, determine which machine you should buy. Assume that machine B will be available in the future at the same costs. Enter the Annual Equivalent Cost as a positive number of the preferred machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts