Question: Your company's management is interested in understanding how sensitivity analysis and Monte Carlo simulation can be used to access the stand-alone risk of a capital

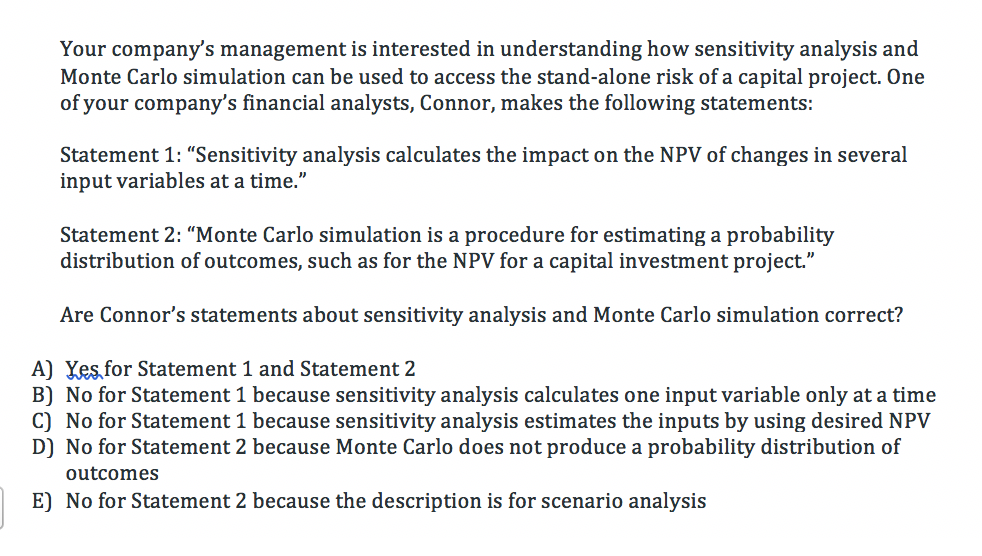

Your company's management is interested in understanding how sensitivity analysis and Monte Carlo simulation can be used to access the stand-alone risk of a capital project. One of your company's financial analysts, Connor, makes the following statements: Statement 1: "Sensitivity analysis calculates the impact on the NPV of changes in several input variables at a time." Statement 2: "Monte Carlo simulation is a procedure for estimating a probability distribution of outcomes, such as for the NPV for a capital investment project." Are Connor's statements about sensitivity analysis and Monte Carlo simulation correct? A) es for Statement 1 and Statement 2 B) No for Statement 1 because sensitivity analysis calculates one input variable only at a time C) No for Statement 1 because sensitivity analysis estimates the inputs by using desired NPV D) No for Statement 2 because Monte Carlo does not produce a probability distribution of outcomes E) No for Statement 2 because the description is for scenario analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts