Question: . Your Days left in your Wiley Street Assignment sent to Gradebook Your grade is being recorded Fri May 22, 2000, 8:19:06 PM (America New

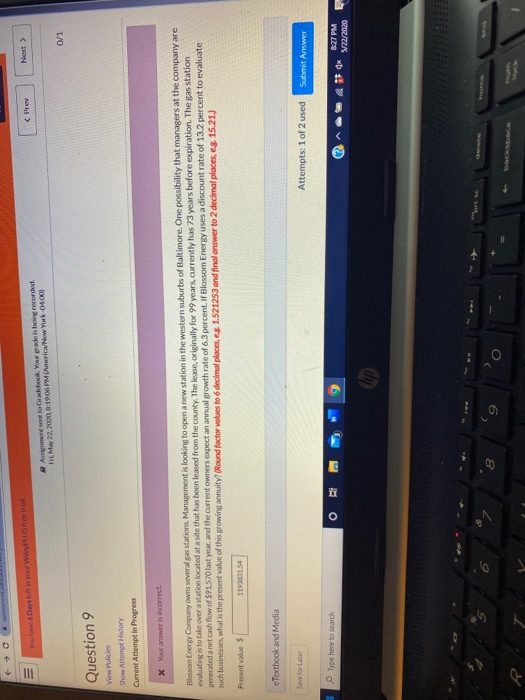

. Your Days left in your Wiley Street Assignment sent to Gradebook Your grade is being recorded Fri May 22, 2000, 8:19:06 PM (America New York-02.00 0/1 Question 9 View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. Blossom Energy Company owns several gas stations Management is looking to open a new station in the western suburbs of Baltimore. One possibility that managers at the company are evaluating is to take over a station located at a site that has been leased from the county. The lease, originally for 99 years, currently has 73 years before expiration. The gas station generated a net cash flow of $91,570 last year, and the current owners expect an annual growth rate of 6.3 percent. If Blossom Energy uses a discount rate of 13.2 percent to evaluate such businesses, what is the present value of this growing annuity? (Round factor values to decimal places, es. 1.521253 and final answer to 2 decimal places, eg. 15.21.) Present value 5 119330154 e Textbook and Media Save for Laser Attempts: 1 of 2 used Submit Answer Type here to search 827 PM 5/22/2020 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts