Question: Your department is choosing between two technology projects to launch in the upcoming quarter. Project A requires an immediate $500,000 investment and will generate $100,000

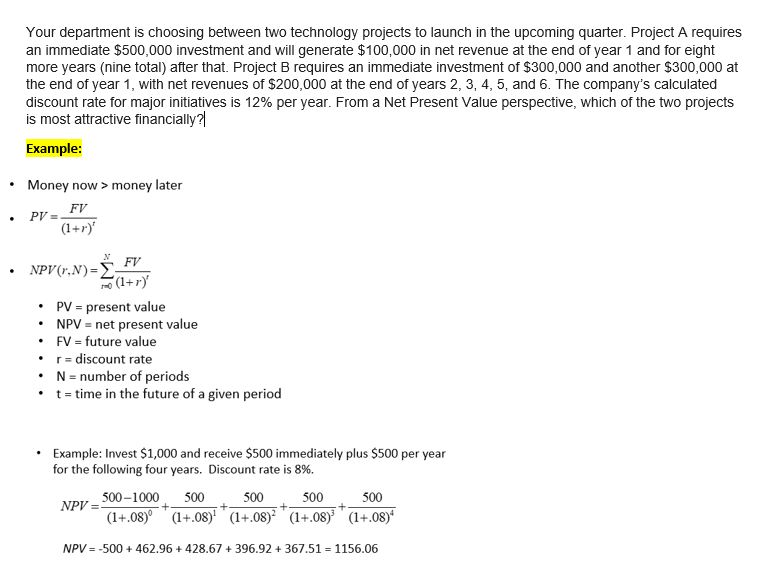

Your department is choosing between two technology projects to launch in the upcoming quarter. Project A requires an immediate $500,000 investment and will generate $100,000 in net revenue at the end of year 1 and for eight more years (nine total) after that. Project B requires an immediate investment of $300,000 and another $300,000 at the end of year 1, with net revenues of $200,000 at the end of years 2, 3, 4, 5, and 6. The company's calculated discount rate for major initiatives is 12% per year. From a Net Present Value perspective, which of the two projects is most attractive financially? Example: Money now > money later FV PV = (1+r) . . FV NPV (1.N) - (1+r) PV = present value NPV = net present value FV = future value r = discount rate N = number of periods . t= time in the future of a given period Example: Invest $1,000 and receive $500 immediately plus $500 per year for the following four years. Discount rate is 8%. 500-1000 500 500 500 NPV = (1+.08) (1+.08)! (1+.08) (1+.08) (1+.08)* 500 + NPV = -500 + 462.96 +428.67 + 396.92 + 367.51 = 1156.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts