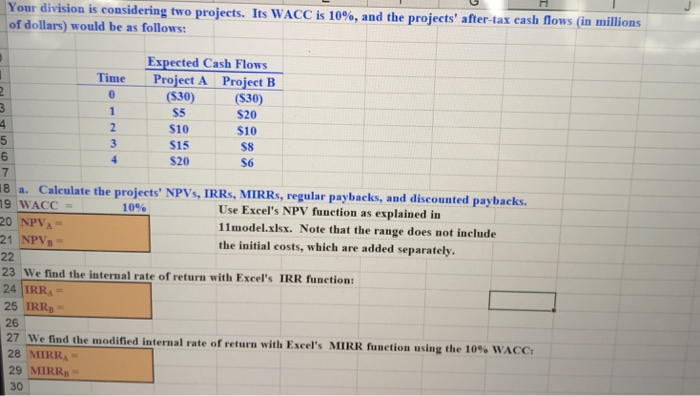

Question: Your division is considering two projects. Its wACC is 10%, and the projects after-tax cash flows (in millions of dollars) would be as follows Expected

Your division is considering two projects. Its wACC is 10%, and the projects after-tax cash flows (in millions of dollars) would be as follows Expected Cash Flows Time Project A Project B (S30 S5 S10 S15 S20 (S30) S20 S10 S8 S6 6 7 8 a. Calculate the projects' NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. Use Excel's NPV function as explained in 11model.xlsx. Note that the range does not include the initial costs, which are added separately. 10% 9 WACC 0 NPVA 21 NPVB 23 We find the internal rate of return with Excel's IRR function 24 IRRA 25 IRR 26 0% wACC 27 We find the modified internal rate of return with Excel's MIRR function using the 1 28 MIRRA 29 MIRR 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts