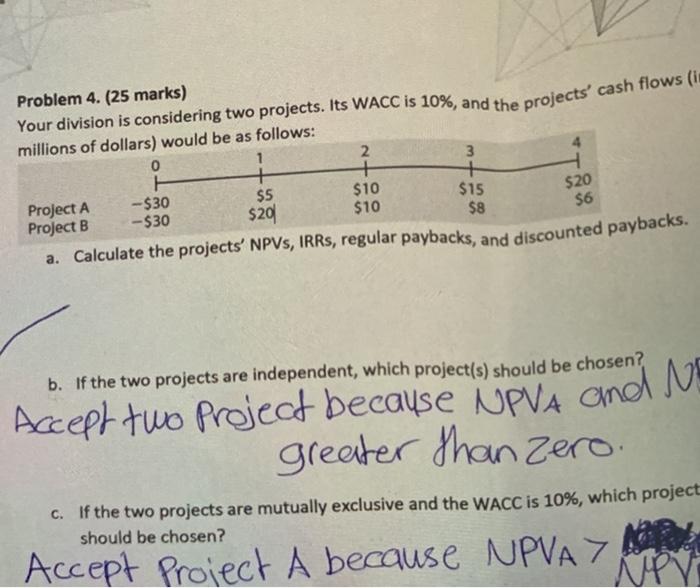

Question: Your division is considering two projects. Its WACC is 10%, and the projects' cash flows (i a. Calculate the projects' NPVs, IRRs, regular paybacks, and

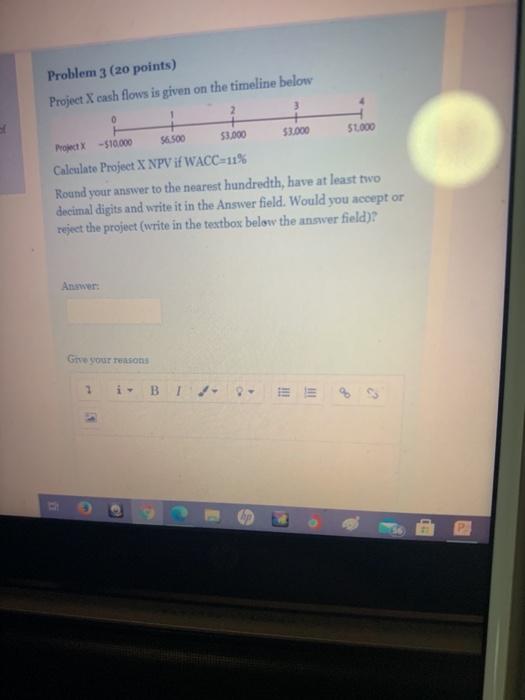

Your division is considering two projects. Its WACC is 10%, and the projects' cash flows (i a. Calculate the projects' NPVs, IRRs, regular paybacks, and discounted paybacks. Problem 4. (25 marks) millions of dollars) would be as follows: 2 1 0 3 H + + -$30 Project A $5 $10 $15 -$30 Project B $10 $20 $8 $20 $6 b. If the two projects are independent, which project(s) should be chosen? Accept two project because NPVA and NE greater than zero. c. If the two projects are mutually exclusive and the WACC is 10%, which project should be chosen? NPVAT NPY Accept Project A because NPVAY for Problem 3 (20 points) Project X cash flows is given on the timeline below 2 $6.500 53.000 53.000 ProiectX - 510.000 51000 Calculate Project X NPV if WACC-11% Round your answer to the nearest hundredth, have at least two decimal digits and write it in the Answer field. Would you accept or reject the project (write in the textbox below the answer field)? Answer: Give your ons P X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts