Question: your exam is 50 points. Section I: Analytical problems ( 40 points) Problem 1 (5 pts.): One of my retail clients just joined my investment

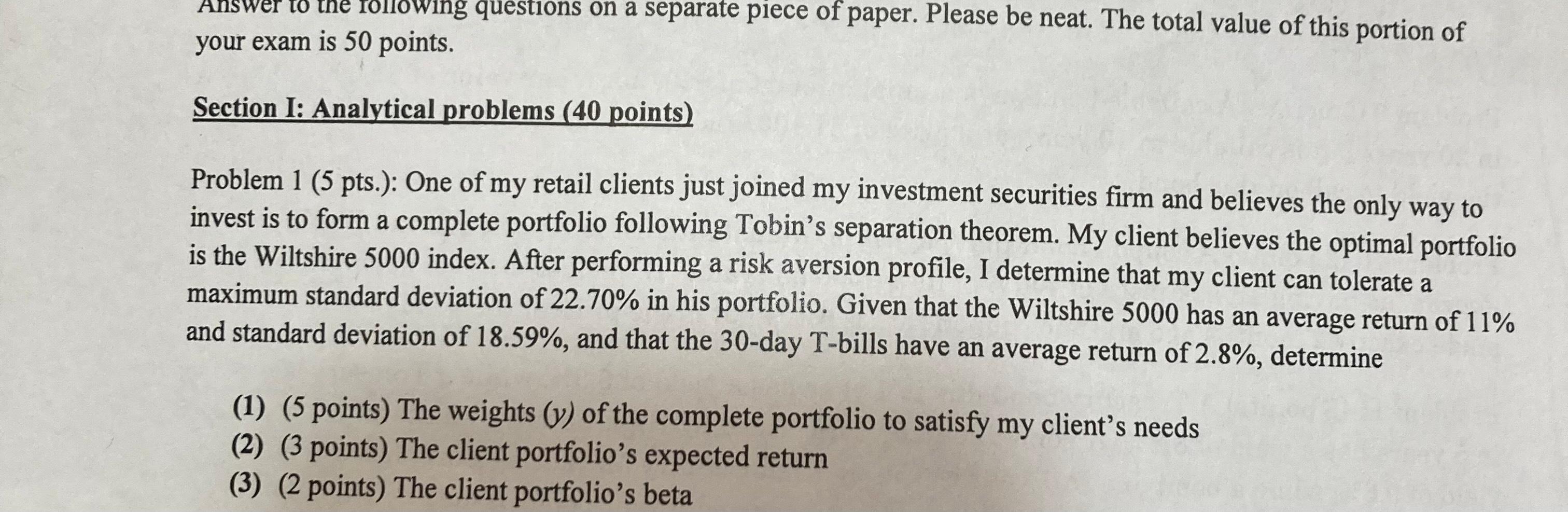

your exam is 50 points. Section I: Analytical problems ( 40 points) Problem 1 (5 pts.): One of my retail clients just joined my investment securities firm and believes the only way to invest is to form a complete portfolio following Tobin's separation theorem. My client believes the optimal portfolio is the Wiltshire 5000 index. After performing a risk aversion profile, I determine that my client can tolerate a maximum standard deviation of 22.70% in his portfolio. Given that the Wiltshire 5000 has an average return of 11% and standard deviation of 18.59%, and that the 30 -day T-bills have an average return of 2.8%, determine (1) (5 points) The weights (y) of the complete portfolio to satisfy my client's needs (2) (3 points) The client portfolio's expected return (3) (2 points) The client portfolio's beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts