Question: Your expectations for this stabilized property include the following: first-year potential gross income of $4,250,000; vacancy and collection losses equal to 4% of potential gross

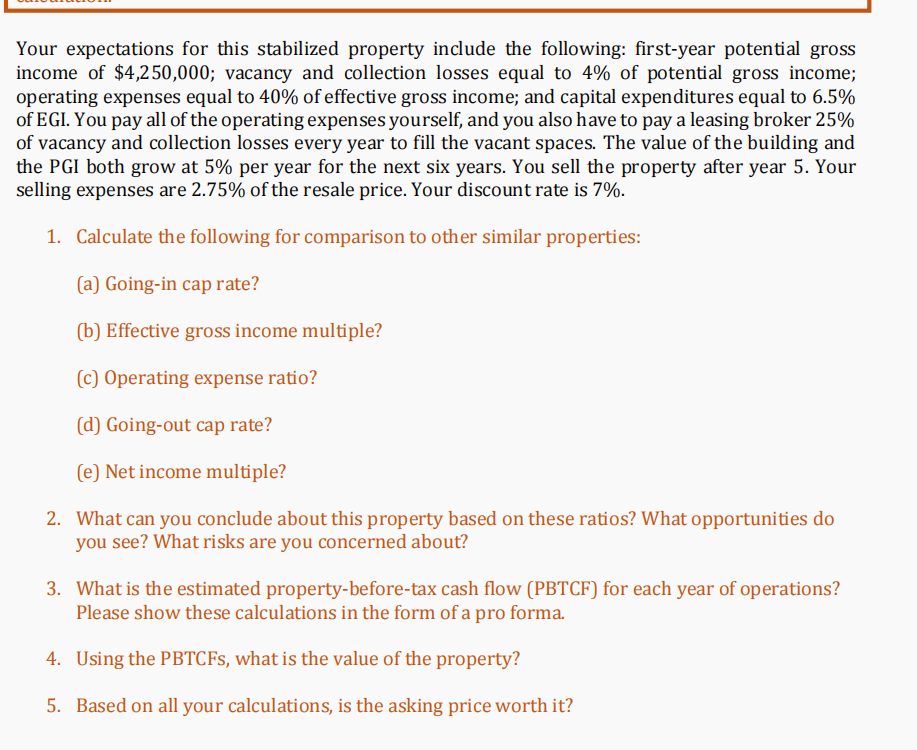

Your expectations for this stabilized property include the following: first-year potential gross income of $4,250,000; vacancy and collection losses equal to 4% of potential gross income; operating expenses equal to 40% of effective gross income; and capital expenditures equal to 6.5% of EGI. You pay all of the operating expenses yourself, and you also have to pay a leasing broker 25% of vacancy and collection losses every year to fill the vacant spaces. The value of the building and the PGI both grow at 5% per year for the next six years. You sell the property after year 5. Your selling expenses are 2.75% of the resale price. Your discount rate is 7%. 1. Calculate the following for comparison to other similar properties: (a) Going-in cap rate? (b) Effective gross income multiple? (C) Operating expense ratio? (d) Going-out cap rate? (e) Net income multiple? 2. What can you conclude about this property based on these ratios? What opportunities do you see? What risks are you concerned about? 3. What is the estimated property-before-tax cash flow (PBTCF) for each year of operations? Please show these calculations in the form of a pro forma. 4. Using the PBTCFs, what is the value of the property? 5. Based on all your calculations, is the asking price worth it? Your expectations for this stabilized property include the following: first-year potential gross income of $4,250,000; vacancy and collection losses equal to 4% of potential gross income; operating expenses equal to 40% of effective gross income; and capital expenditures equal to 6.5% of EGI. You pay all of the operating expenses yourself, and you also have to pay a leasing broker 25% of vacancy and collection losses every year to fill the vacant spaces. The value of the building and the PGI both grow at 5% per year for the next six years. You sell the property after year 5. Your selling expenses are 2.75% of the resale price. Your discount rate is 7%. 1. Calculate the following for comparison to other similar properties: (a) Going-in cap rate? (b) Effective gross income multiple? (C) Operating expense ratio? (d) Going-out cap rate? (e) Net income multiple? 2. What can you conclude about this property based on these ratios? What opportunities do you see? What risks are you concerned about? 3. What is the estimated property-before-tax cash flow (PBTCF) for each year of operations? Please show these calculations in the form of a pro forma. 4. Using the PBTCFs, what is the value of the property? 5. Based on all your calculations, is the asking price worth it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts