Question: Your financial statement analysis must include the calculation and interpretation of the following ratios for the assigned company Debt Management Ratios - (10 marks) begin{tabular}{|c|c|}

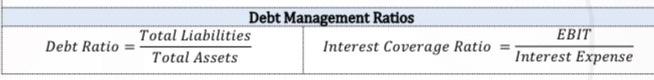

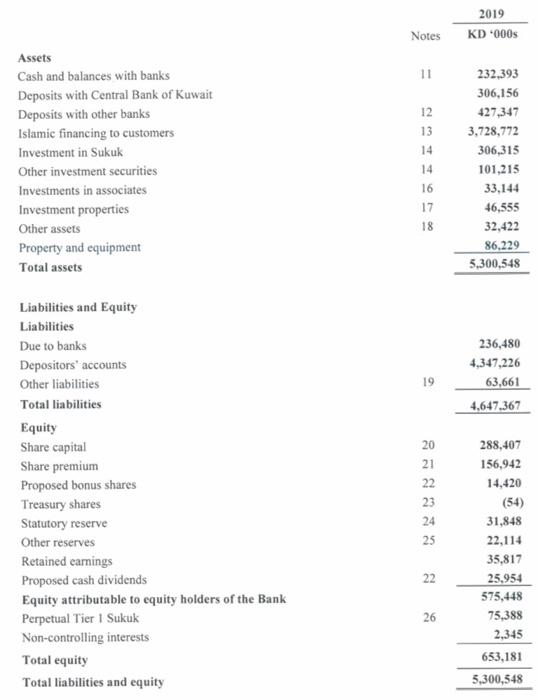

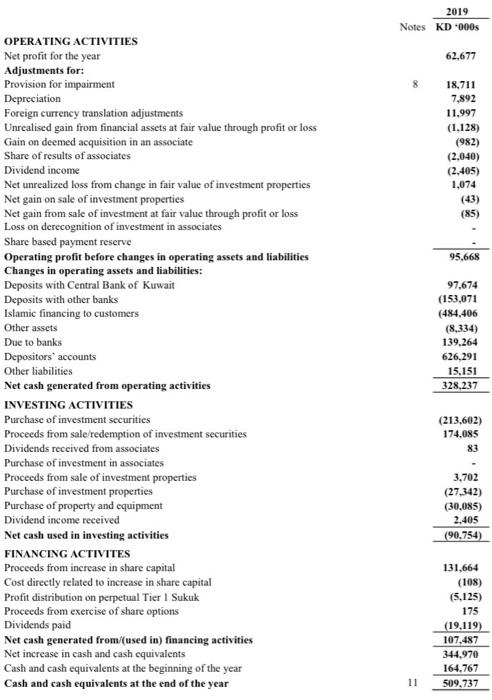

Your financial statement analysis must include the calculation and interpretation of the following ratios for the assigned company Debt Management Ratios - (10 marks) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Debt Management Ratios } \\ \hline Debt Ratio =TotalAssetsTotalLiabilities & Interest Coverage Ratio =InterestExpenseEBIT \\ \hline \end{tabular} Notes KD000s2019 Income Murabaha and other Islamic financing income \begin{tabular}{ll} 5 & 207,629 \\ & (88,170) \\ \hline & 119,459 \\ \hline \end{tabular} Net investment income Net fees and commission income Share of results of associates Net foreign exchange gain Operating income \begin{tabular}{cr} 6 & 4,155 \\ 7 & 16,428 \\ 16 & 2,040 \\ & 3,687 \\ \hline & 145,769 \\ \hline \end{tabular} Staff costs General and administrative expenses Depreciation Operating expenses Operating profit before provision for impairment Provision for impairment Operating profit before taxation and board of directors' remuneration Taxation Board of directors' remuneration Net profit for the year (36,094)(17,078)(7,892)(61,064) Attributable to: Equity holders of the Bank Non-controlling interests Net profit for the year Basic and diluted earnings per share attributable to the equity holders of the Bank (fils) 10 62,6473062,677 Notes KD000s2019 Assets Cash and balances with banks Deposits with Central Bank of Kuwait 11232,393 Deposits with other banks 306,156 Islamic financing to customers Investment in Sukuk Other investment securities Investments in associates Investment properties Other assets Property and equipment Total assets Liabilities and Equity Liabilities Due to banks Depositors' accounts Other liabilities \( 19 \quad \frac{63,661}{\hline 4,647,367} \) Total liabilities Equity Share capital Share premium Proposed bonus shares 121314427,3473,728,772306,315 Treasury shares 1416101,21533,144 Statutory reserve Other reserves 1746,555 1832,422 Retained earnings Proposed cash dividends Equity attributable to equity holders of the Bank Perpetual Tier 1 Sukuk Non-controlling interests. Total equity Total liabilities and equity \begin{tabular}{rr} 20 & 288,407 \\ 21 & 156,942 \\ 22 & 14,420 \\ 23 & (54) \\ 24 & 31,848 \\ 25 & 22,114 \\ & 35,817 \\ 22 & 25,954 \\ \hline & 575,448 \\ 26 & 75,388 \\ & 2,345 \\ \hline \end{tabular} OPERATING ACTIVITIES Notes KD000s2019 Net profit for the year Adjustments for: Provision for impairment Depreciation Foreign currency translation adjustments Unrealised gain from financial assets at fair value through profit or loss 62,677 Gain on deemed acquisition in an associate Share of results of associates Dividend income Net unrealized loss from change in fair value of investment properties 8 18,711 7,892 Net gain on sale of investment properties 11.997 Net gain from sale of investment at fair value through profit or loss (1,128) Loss on derecognition of investment in associates Share based payment reserve Operating profit before changes in operating assets and liabilities (982) Changes in operating assets and liabilities: Deposits with Central Bank of Kuwait Deposits with other banks (2,040) (2,405) 1,074 Islamic financing to customers (43) (85) Other assets Due to banks Depositors' accounts Other liabilities Net cash generated from operating activities INVESTING ACTIVITIES Purchase of investment securities Proceeds from sale/redemption of investment securities Dividends received from associates Purchase of investment in associates Proceeds from sale of investment properties Purchase of investment properties Purchase of property and equipment Dividend income received Net cash used in investing activities FINANCING ACTIVITES Proceeds from inerease in share capital Cost directly related to increase in share capital Profit distribution on perpetual Tier I Sukuk Proceeds from exercise of share options Dividends paid Net cash generated from/(used in) financing activities Net increase in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year 11164,767509,737

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts