Question: Your firm has a single copy machine for the tenth floor, and it has broken down yet again. Your firm must decide how to

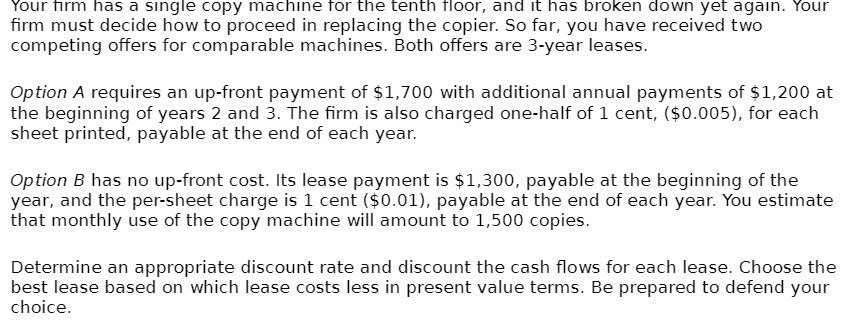

Your firm has a single copy machine for the tenth floor, and it has broken down yet again. Your firm must decide how to proceed in replacing the copier. So far, you have received two competing offers for comparable machines. Both offers are 3-year leases. Option A requires an up-front payment of $1,700 with additional annual payments of $1,200 at the beginning of years 2 and 3. The firm is also charged one-half of 1 cent, ($0.005), for each sheet printed, payable at the end of each year. Option B has no up-front cost. Its lease payment is $1,300, payable at the beginning of the year, and the per-sheet charge is 1 cent ($0.01), payable at the end of each year. You estimate that monthly use of the copy machine will amount to 1,500 copies. Determine an appropriate discount rate and discount the cash flows for each lease. Choose the best lease based on which lease costs less in present value terms. Be prepared to defend your choice.

Step by Step Solution

There are 3 Steps involved in it

To compare the two lease options we need to discount their cash flows to present value terms using a... View full answer

Get step-by-step solutions from verified subject matter experts