Question: Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $506,000 as an upfront

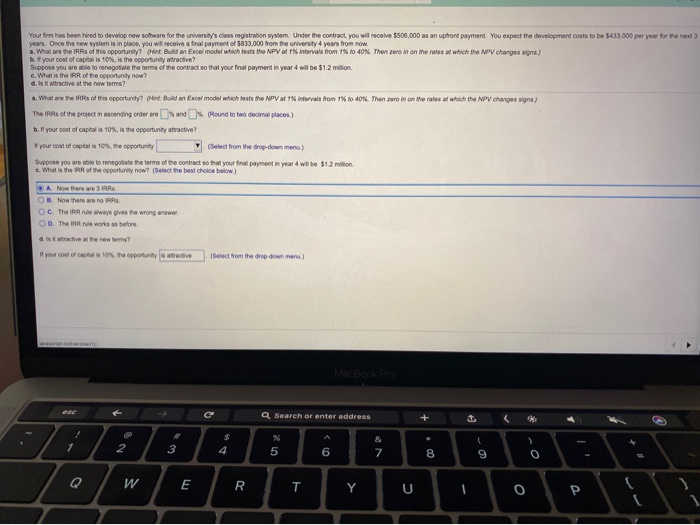

Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $506,000 as an upfront payment. You expect the development costs to be $433.000 per year for the next years. Once the new system is in place, you will receive a final payment of 5833,000 from the university 4 years from now. a. What are the IRR of this opponunity? (Hint. Build an Excel model which tests the NPV at interval from 15 to 40%. Then 2010 in on the rates at which the NPV changes signs.) but your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegol the terms of the contract so that your final payment in year 4 will be $1.2 milion What is the IRR of the opportunity now? d. Is it tractive at the new tema? .. What are the IRR of this opportunity? Mire: Buid en Excel model which posts the NPV at 1% intervals from 1% to 40%. Ther zero in on the rates at which the NPV changes signs) The IRR of the project in ascending order ore 1% and [Round to two decimal places.) b. If your cost of capital is 10%, is the opportunity atractive? your cost of capital is 10%, the opportunity (Select from the drop-down menu) Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 wil be $1.2 million c. What is the IRR of the opportunity now? (Select the best choice below) A Now there are 3RRS OB. Now there are no RR OC. There wways gives the wrong answer OD. The works as before distractive there term? if your cost of capital is to the opportunity is tradive Select from the drop-down menu) MacBook Pro Q Search or enter address 1 2 3 4 % 5 6 & 7 8 C 9 o Q W E R T Y U 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts