Question: Your firm has estimated that it will spend $ 2 0 million on new capital budgeting projects during the coming year. You have been asked

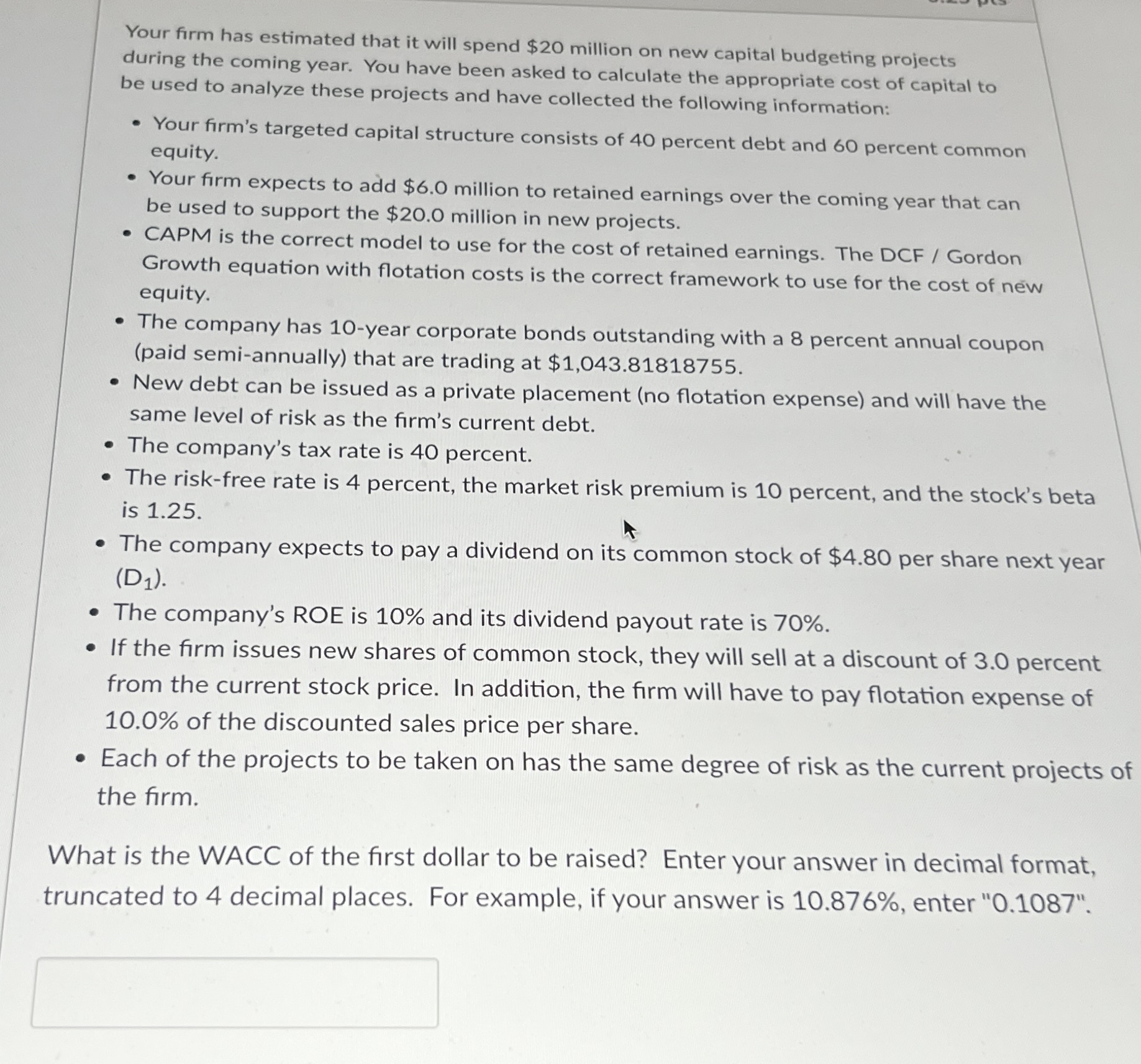

Your firm has estimated that it will spend $ million on new capital budgeting projects during the coming year. You have been asked to calculate the appropriate cost of capital to be used to analyze these projects and have collected the following information:

Your firm's targeted capital structure consists of percent debt and percent common equity.

Your firm expects to add $ million to retained earnings over the coming year that can be used to support the $ million in new projects.

CAPM is the correct model to use for the cost of retained earnings. The DCFGordon Growth equation with flotation costs is the correct framework to use for the cost of new equity.

The company has year corporate bonds outstanding with a percent annual coupon paid semiannually that are trading at $

New debt can be issued as a private placement no flotation expense and will have the same level of risk as the firm's current debt.

The company's tax rate is percent.

The riskfree rate is percent, the market risk premium is percent, and the stock's beta is

The company expects to pay a dividend on its common stock of $ per share next year

The company's ROE is and its dividend payout rate is

If the firm issues new shares of common stock, they will sell at a discount of percent from the current stock price. In addition, the firm will have to pay flotation expense of of the discounted sales price per share.

Each of the projects to be taken on has the same degree of risk as the current projects of the firm.

What is the WACC of the first dollar to be raised? Enter your answer in decimal format, truncated to decimal places. For example, if your answer is enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock