Question: Your firm has two bond issues outstanding, The first consists of 23,000 bonds denominated in Euros, which have a face value of 1,000 thot pay

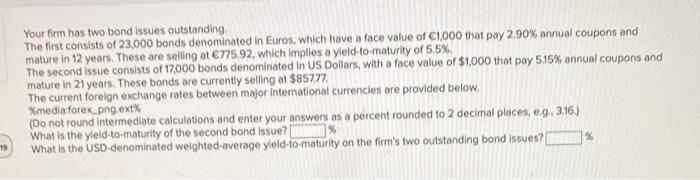

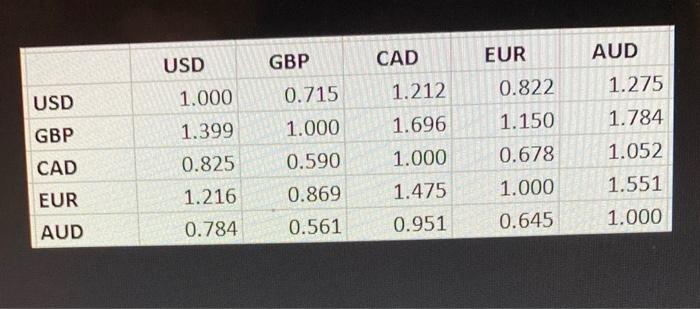

Your firm has two bond issues outstanding, The first consists of 23,000 bonds denominated in Euros, which have a face value of 1,000 thot pay 2.90% annual coupons and mature in 12 years. These are selling at 775.92, which implies a yield-to-maturity of 5,5% The second issue consists of 17,000 bonds denominated in US Dollars, with a face value of $1,000 thot pay 515% annual coupons and mature in 21 years. These bonds are currently seling at $857.77 The current foreign exchange rates between major international currencies are provided below. media:forex png.ext% (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 3.16.) What is the yield-to-maturity of the second bond issue? What is the USD-denominated weighted-average yield-to-maturity on the firm's two outstanding bond issues? % 19 USD GBP CAD EUR AUD 0.822 USD 1.000 0.715 1.399 GBP 1.212 1.696 1.000 1.000 1.275 1.784 1.052 1.551 1.000 1.150 0.678 1.000 CAD 0.590 0.869 0.825 1.216 0.784 1.475 EUR AUD 0.561 0.951 0.645

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts