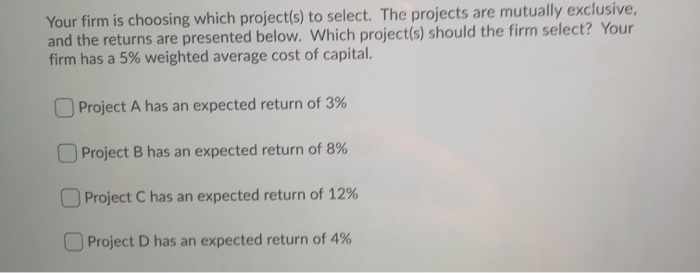

Question: Your firm is choosing which project(s) to select. The projects are mutually exclusive, and the returns are presented below. Which project(s) should the firm select?

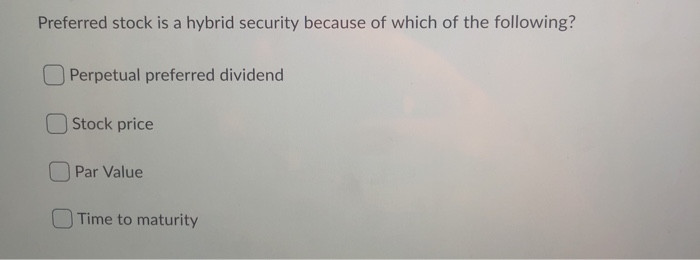

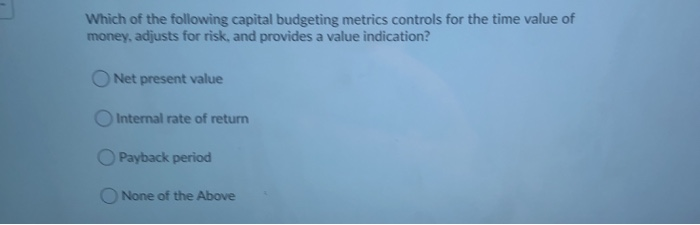

Your firm is choosing which project(s) to select. The projects are mutually exclusive, and the returns are presented below. Which project(s) should the firm select? Your firm has a 5% weighted average cost of capital. O Project A has an expected return of 3% Project B has an expected return of 8% Project C has an expected return of 12% Project D has an expected return of 4% Preferred stock is a hybrid security because of which of the following? Perpetual preferred dividend Stock price Par Value Time to maturity Which of the following capital budgeting metrics controls for the time value of money, adjusts for risk, and provides a value indication? Net present value Internal rate of return Payback period None of the Above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts