Question: Your firm is considering a new project. The project will generate incremental revenues of $2,475,000 per year and incremental costs (other than depreciation) of $1,000,000

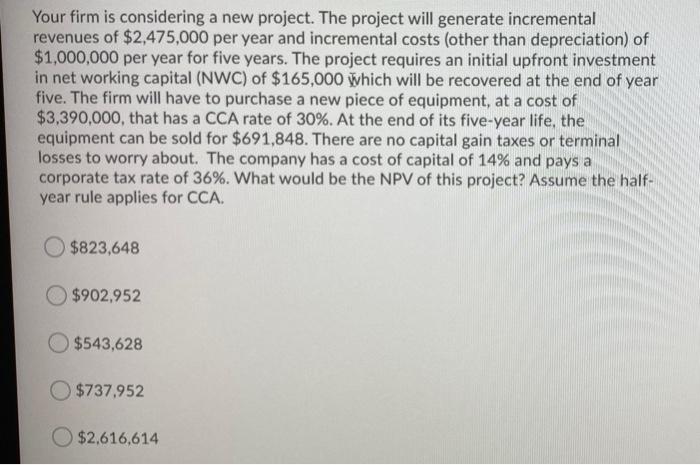

Your firm is considering a new project. The project will generate incremental revenues of $2,475,000 per year and incremental costs (other than depreciation) of $1,000,000 per year for five years. The project requires an initial upfront investment in net working capital (NWC) of $165,000 which will be recovered at the end of year five. The firm will have to purchase a new piece of equipment, at a cost of $3.390,000, that has a CCA rate of 30%. At the end of its five-year life, the equipment can be sold for $691,848. There are no capital gain taxes or terminal losses to worry about. The company has a cost of capital of 14% and pays a corporate tax rate of 36%. What would be the NPV of this project? Assume the half- year rule applies for CCA. $823,648 $902,952 $543,628 O $737,952 $2,616,614

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts