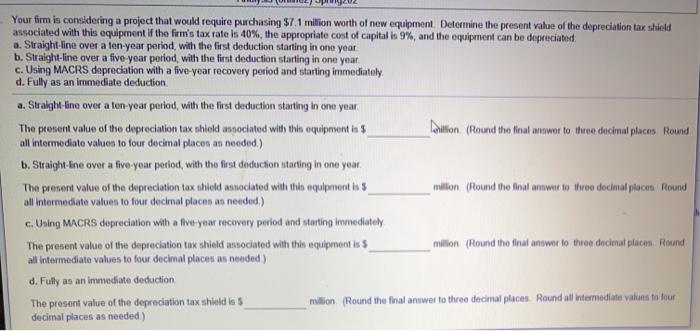

Question: Your firm is considering a project that would require purchasing $7.1 milion worth of new equipment Determine the present value of the depreciation tax shield

Your firm is considering a project that would require purchasing $7.1 milion worth of new equipment Determine the present value of the depreciation tax shield associated with this equipment if the firm's tax rate is 40%, the appropriate cost of capital is 9%, and the equipment can be depreciated a. Straight line over a ten-year period, with the first deduction starting in one year b. Straight-line over a five year period, with the first deduction starting in one year c. Using MACRS depreciation with a five year recovery period and starting immediately d. Fully as an immediate deduction a. Straight-line over a ten-year period, with the first deduction starting in one year The present value of the depreciation tax shield asociated with the equipment is 5 Dhillon (Round the final armwer to three decimal places. Round all intermediate values to four decimal places as needed) b. Straight-line over a five-year period, with the first deduction starting in one year The present value of the depreciation tax shold annociated with this equipment to million (Round the final amwer to three decimal place Round all Intermediate values to four decimal places as needed) c. Using MACRS depreciation with a five-year recovery period and starting immediately The present value of the depreciation tax shield associated with this equipment is million (Round the final answer to three decimal place Round all intermediate values to four decimal places as needed) d. Fully as an immediate deduction million (Round the final answer to three decimal places. Round all intermediate values to four The present value of the depreciation tax shield is s decimal places as needed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts