Question: Your firm is considering a project which has an initial investment of $5 million. Your target D/E ratio is .67. Flotation costs on equity are

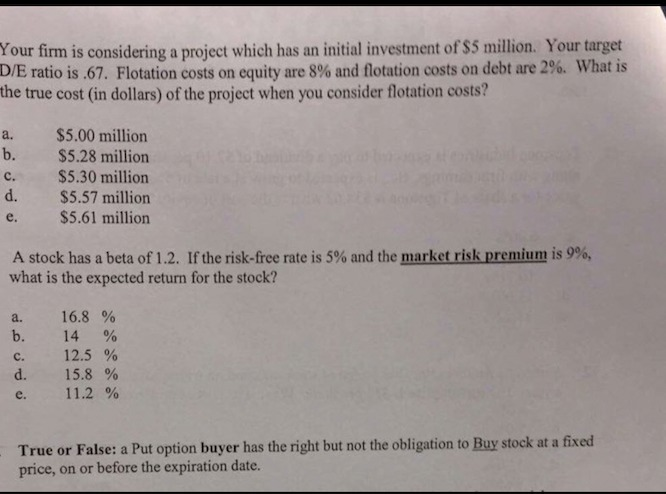

Your firm is considering a project which has an initial investment of $5 million. Your target D/E ratio is .67. Flotation costs on equity are 8% and flotation costs on debt are 2%. What is the true cost (in dollars) of the project when you consider flotation costs? a. $5.00 million b. $5.28 million c. $5.30 million d. $5.57 million e. $5.61 million A stock has a beta of 1.2. If the risk-free rate is 5% and the market risk premium is 9%, what is the expected return for the stock? a. b. c. d. 16.8 % 14 % 12.5 % 15.8 % 11.2 % e. True or False: a Put option buyer has the right but not the obligation to Buy stock at a fixed price, on or before the expiration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts