Question: Your firm is considering two options to replace an aging compactor. Option #1 - Purchase a new compactor for $30,000. The new compactor is expected

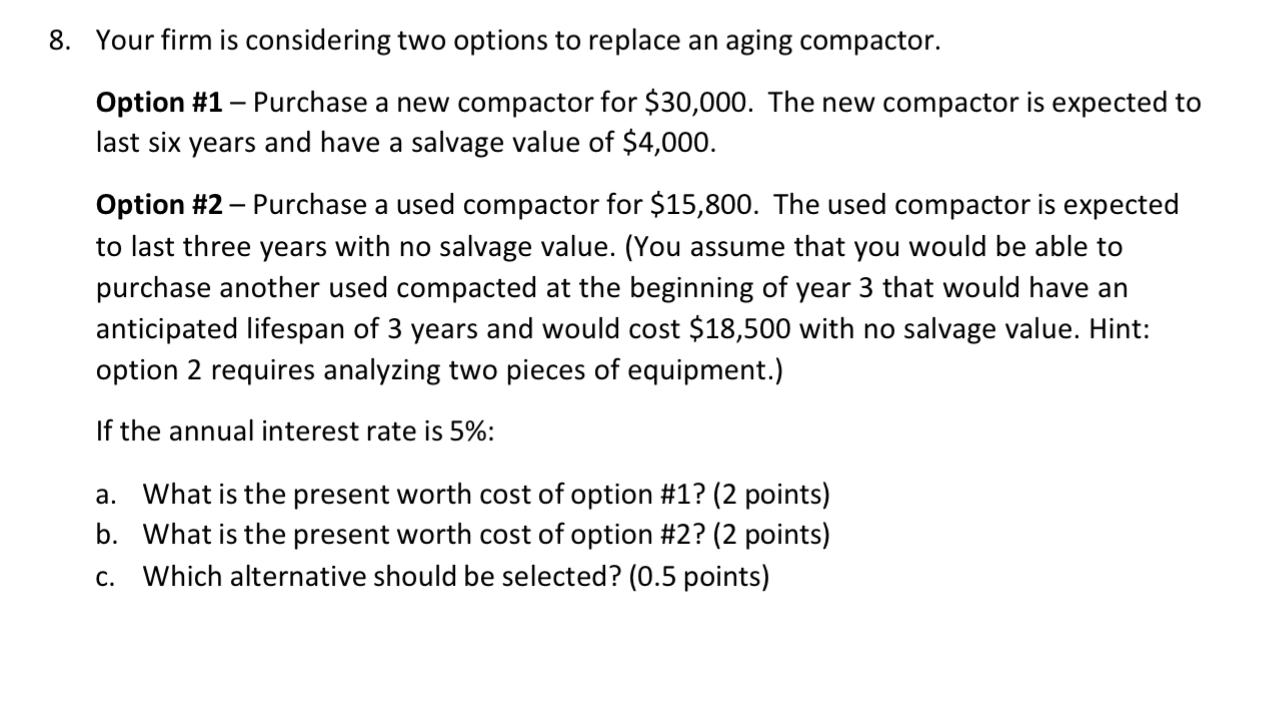

Your firm is considering two options to replace an aging compactor. Option \#1 - Purchase a new compactor for $30,000. The new compactor is expected to last six years and have a salvage value of $4,000. Option \#2 - Purchase a used compactor for $15,800. The used compactor is expected to last three years with no salvage value. (You assume that you would be able to purchase another used compacted at the beginning of year 3 that would have an anticipated lifespan of 3 years and would cost $18,500 with no salvage value. Hint: option 2 requires analyzing two pieces of equipment.) If the annual interest rate is 5% : a. What is the present worth cost of option \#1? ( 2 points) b. What is the present worth cost of option \#2? (2 points) c. Which alternative should be selected? ( 0.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts