Question: Your firm is purchasing a new computer server that will last for five years. The firm can purchase the system for an upfront cost of

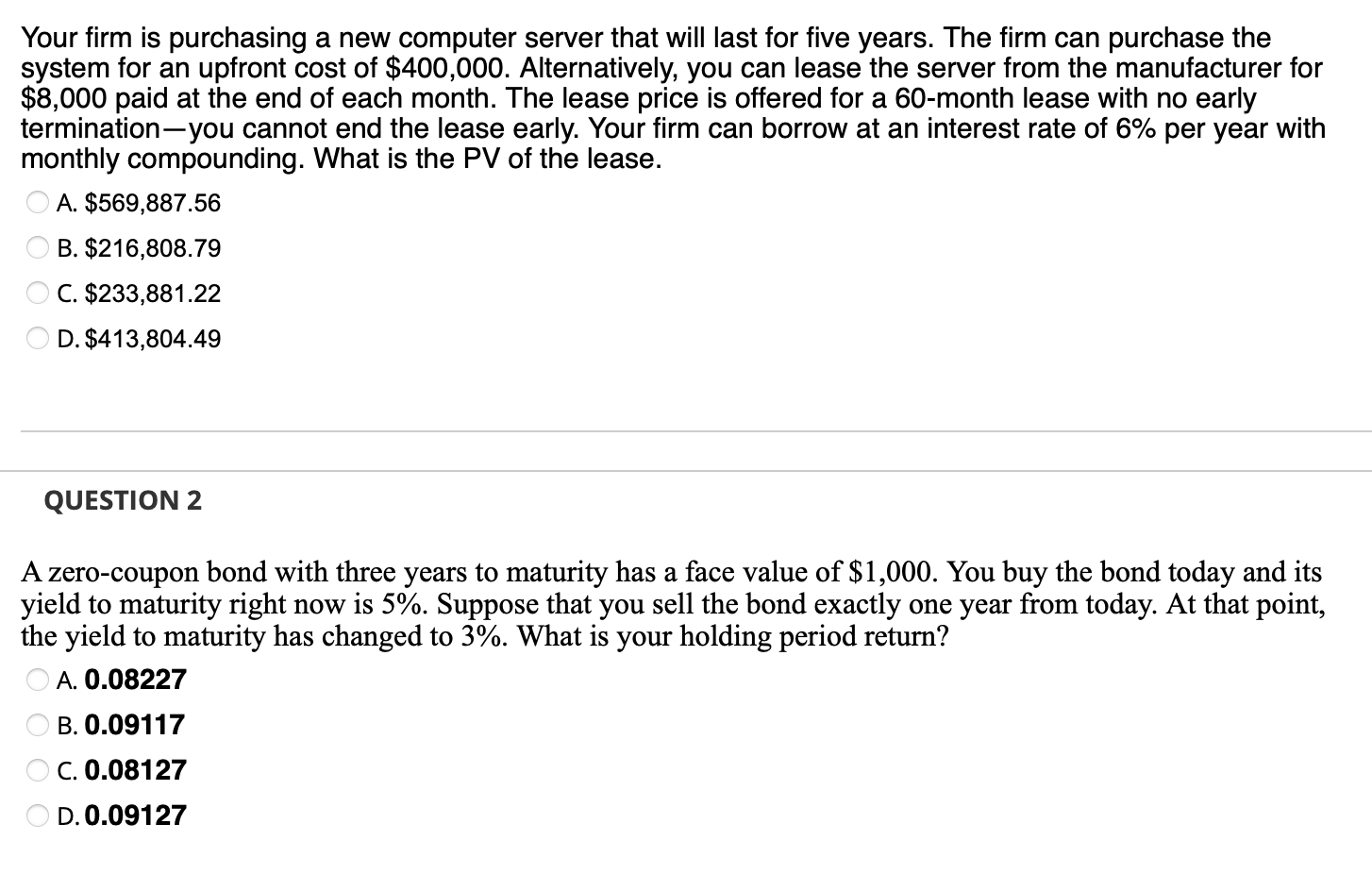

Your firm is purchasing a new computer server that will last for five years. The firm can purchase the

system for an upfront cost of $ Alternatively, you can lease the server from the manufacturer for

$ paid at the end of each month. The lease price is offered for a month lease with no early

terminationyou cannot end the lease early. Your firm can borrow at an interest rate of per year with

monthly compounding. What is the PV of the lease.

A $

B $

C $

D $

QUESTION

A zerocoupon bond with three years to maturity has a face value of $ You buy the bond today and its

yield to maturity right now is Suppose that you sell the bond exactly one year from today. At that point,

the yield to maturity has changed to What is your holding period return?

A

B

C

D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock