Question: Your firm recently divested some non-core assets and now has a significant amount of excess cash. Branda Sim, the CEO, is considering investing in either

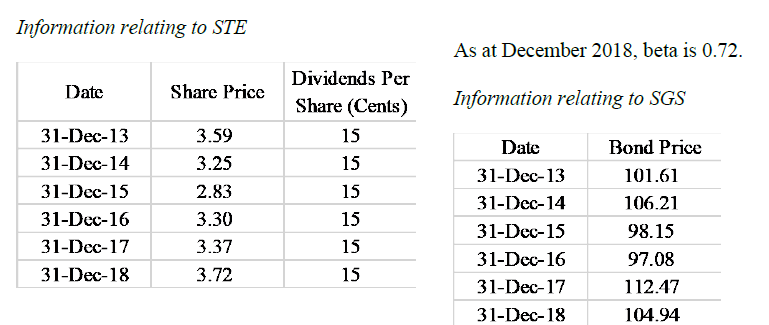

Your firm recently divested some non-core assets and now has a significant amount of excess cash. Branda Sim, the CEO, is considering investing in either Singapore Technologies Engineering Limited (STE) shares or 10-year Singapore Government Securities (SGS) or a combination of both. She knows that you are studying a Finance course, and she is seeking your advice. Based on your research, the following market data was obtained:

Question:

Calculate the historical arithmetic and geometric average returns of both STE and SGS over the last 5 years.

Information relating to STE As at December 2018, beta is 0.72 Dividends Per Date Share Price Information relating to SGS Share (Cents) 31-Dec-13 3.59 15 Date Bond Price 31-Dec-14 3.25 15 31-Dec-13 101.61 15 31-Dec-15 2.83 31-Dec-14 106.21 31-Dec-16 3.30 15 31-Dec-15 98.15 31-Dec-17 3.37 15 31-Dec-16 97.08 31-Dec-18 3.72 15 31-Dec-17 112.47 31-Dec-18 104.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts