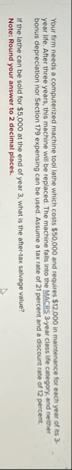

Question: Your frm needs a computerized machine tool lathe which costs $ 5 0 , 0 0 0 and requires $ 1 2 , 0 0

Your frm needs a computerized machine tool lathe which costs $ and requires $ in maintinance for each year of is year life. After three years, this machine will be replaced. The machine falls into the MACRS year class ife cabegory, and nether bonus deprecimion nor Section expensing can be used. Assume a tax rate of percemt and a discount rate of pencent.

If the lathe can be sold for $ at the end of year what is the aftertax salvage value?

Note: Round your answer to decimal ploces.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock