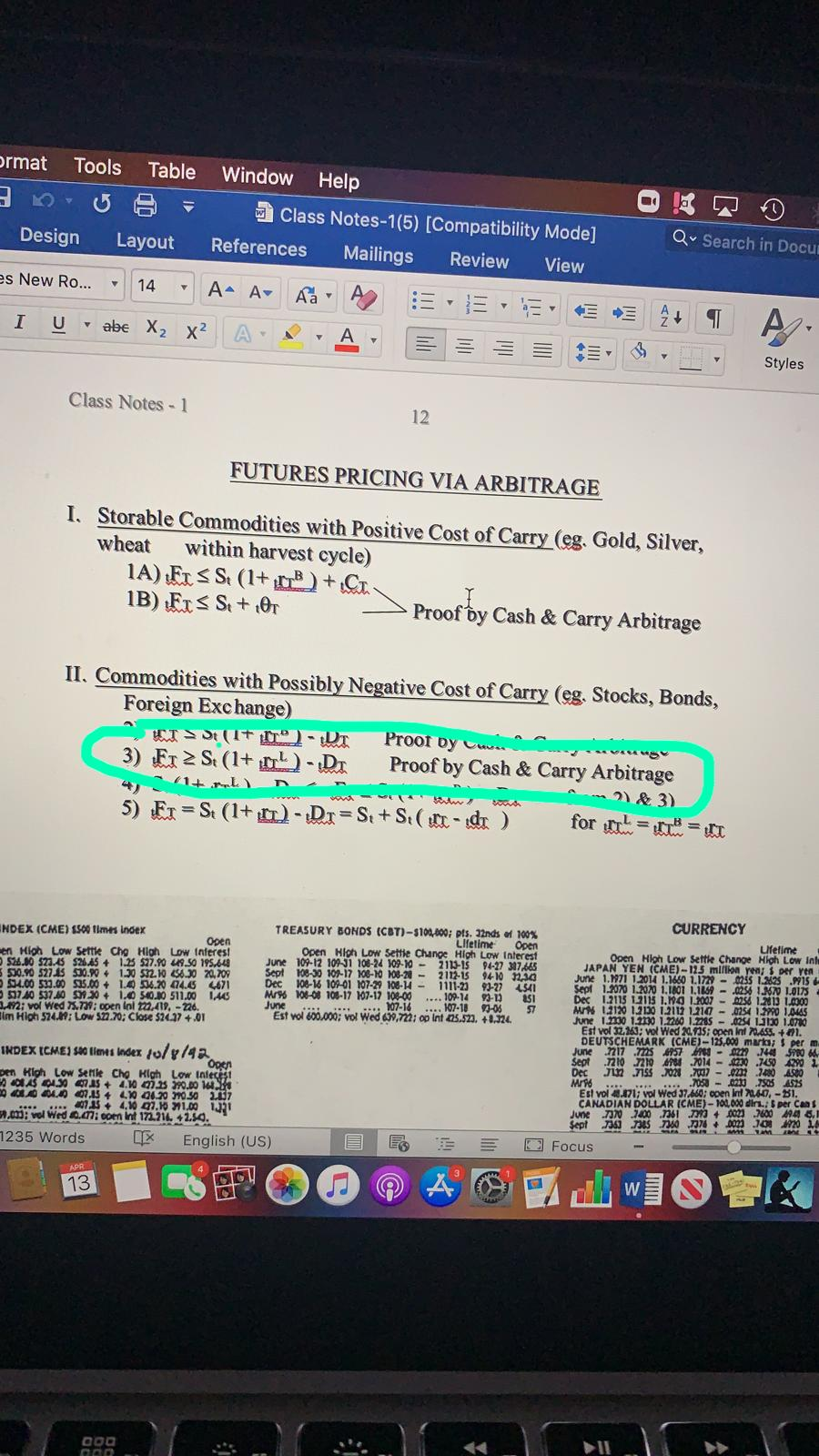

Question: Your homework assignment is to prove equations #3 in Class Notes 1 by the technique of Arbitrage. Your proof should be clear to the point.

Your homework assignment is to prove equations #3 in Class Notes 1 by the technique of Arbitrage.

Your proof should be clear to the point. It should not contain any unnecessary steps. In math terms it should be eloquent.

Simply show that your Arbitrage has no investment and has a positive profit for sure.

ormat Tools Table Window Help U 6 = Class Notes-1(5) [Compatibility Mode] Qv Search in Docul Design Layout References Mailings Review View es New Ro... - 14 - A- A A A : E E 53 4+ A I Uabe X2 X A A 5 $ Styles Class Notes - 1 12 FUTURES PRICING VIA ARBITRAGE I. Storable Commodities with Positive Cost of Carry (eg. Gold, Silver, wheat within harvest cycle) 1A) EL SS (1+ B) + CI IB) FISSE + Or sh & Carry Arbitrage II, Commodities with Possibly Negative Cost of Carry (eg, Stocks, Bonds, Foreign Exchange) t > (TT -D Proof Dy n a 3) Ex 2 S (1+r) - Du Proof by Cash & Carry Arbitrage 1+ r ) 5) Ex =S (1+1)-DI=S+ S( ill-d ) for the = = 1 2 & 3) June NDEX (CME) 500 times index TREASURY BONDS (CBT)-$104,600: Pls. 32nds of 100% CURRENCY Open Lifetime Open Lifetime en High Low Settle Cho High Low interest Open High Low Settle Change High Low Interest 524.00 521.45 $26.45 + 1.25 527.90 49.50 195.648 June 109-12 101-31 100-24 109-10 - 2113-15 Open Hloh Low Settle Change High Low In 94-27 317.665 5500.90 527,45 $30.90 + 1.30 572.10 56.30 20,709 Sept JAPAN YEN (CME) - 125 million years per ven 108-30 101-17 106-100-21 - 2112-15 94-10 12.30 $94.00 530.00 $35.00 + 1.6596.20 414.6 Dec 4671 June 1.1221 1 2014 1.1660 1.1729 - 0255 1.2825 .915 108-16 109-61 107-29 108-14 - 1111-23 93-27 1511 Sept 1.2070 1.207 1.1801 1114 - .0256 1.MX 1.0175 597.10 537.80 S 30 1.0 50.00 511.00 1.16 M7% 106-08 108-17 107-17 108-0 ... 109-14 93-1) 851 Dec 1.2115 2115 ING 1.2007 - 2256 1.21 1.0000 3.112; vor Wed 1.739; open in 72.419,- 226. .... .... 107-16 ... 107-18 23-06 57 Est vol 100.000: Vol Wed 639,77: op Int 65.521. 10.124. mr Im High 574.67: Low 52.70; Close 524.37 4.01 1.3120 1.2130 1.2117 1,210 - .0254 1.390 1.0445 June 1.200 1.2730 1.2260 1.778 - 0254 13130 1.0710 Est vol 32,16); vol Wed 21.735: pen Int 70.455. + 1. DEUTSCHEMARK (CME) - 125.000 marka; $ per m Jure 717 ms 4057 INDEX ICME) 500 tlenes Index 10/8/42 - 0229 744 $700 Open Den High Low Selle Che High Det Low Interest J2 7155 7021 7001 - .0207 7480 Asto MT6 .... .7058 - 0700 .7505 10AS 10430 4715 + 410 035 390.00 10.4 4535 404.40 7.15 4 4.10 20.20 20.50 207 Est vol 40.071; vol Wed 37.660 open In 70.60.-31. . .... 407.35 + 4,10 97.10 1.00 121 CANADIAN DOLLAR (CME) - 100.000 din: 5 per Cans 31.01: vol Wed .. coen in 172.16. 12.54. June 7370 7000 736 70 0023.7600 494 8. Sept 736 7305 730 J7 000 10 10 7235 Words English (US) E E O Focus 14 II ormat Tools Table Window Help U 6 = Class Notes-1(5) [Compatibility Mode] Qv Search in Docul Design Layout References Mailings Review View es New Ro... - 14 - A- A A A : E E 53 4+ A I Uabe X2 X A A 5 $ Styles Class Notes - 1 12 FUTURES PRICING VIA ARBITRAGE I. Storable Commodities with Positive Cost of Carry (eg. Gold, Silver, wheat within harvest cycle) 1A) EL SS (1+ B) + CI IB) FISSE + Or sh & Carry Arbitrage II, Commodities with Possibly Negative Cost of Carry (eg, Stocks, Bonds, Foreign Exchange) t > (TT -D Proof Dy n a 3) Ex 2 S (1+r) - Du Proof by Cash & Carry Arbitrage 1+ r ) 5) Ex =S (1+1)-DI=S+ S( ill-d ) for the = = 1 2 & 3) June NDEX (CME) 500 times index TREASURY BONDS (CBT)-$104,600: Pls. 32nds of 100% CURRENCY Open Lifetime Open Lifetime en High Low Settle Cho High Low interest Open High Low Settle Change High Low Interest 524.00 521.45 $26.45 + 1.25 527.90 49.50 195.648 June 109-12 101-31 100-24 109-10 - 2113-15 Open Hloh Low Settle Change High Low In 94-27 317.665 5500.90 527,45 $30.90 + 1.30 572.10 56.30 20,709 Sept JAPAN YEN (CME) - 125 million years per ven 108-30 101-17 106-100-21 - 2112-15 94-10 12.30 $94.00 530.00 $35.00 + 1.6596.20 414.6 Dec 4671 June 1.1221 1 2014 1.1660 1.1729 - 0255 1.2825 .915 108-16 109-61 107-29 108-14 - 1111-23 93-27 1511 Sept 1.2070 1.207 1.1801 1114 - .0256 1.MX 1.0175 597.10 537.80 S 30 1.0 50.00 511.00 1.16 M7% 106-08 108-17 107-17 108-0 ... 109-14 93-1) 851 Dec 1.2115 2115 ING 1.2007 - 2256 1.21 1.0000 3.112; vor Wed 1.739; open in 72.419,- 226. .... .... 107-16 ... 107-18 23-06 57 Est vol 100.000: Vol Wed 639,77: op Int 65.521. 10.124. mr Im High 574.67: Low 52.70; Close 524.37 4.01 1.3120 1.2130 1.2117 1,210 - .0254 1.390 1.0445 June 1.200 1.2730 1.2260 1.778 - 0254 13130 1.0710 Est vol 32,16); vol Wed 21.735: pen Int 70.455. + 1. DEUTSCHEMARK (CME) - 125.000 marka; $ per m Jure 717 ms 4057 INDEX ICME) 500 tlenes Index 10/8/42 - 0229 744 $700 Open Den High Low Selle Che High Det Low Interest J2 7155 7021 7001 - .0207 7480 Asto MT6 .... .7058 - 0700 .7505 10AS 10430 4715 + 410 035 390.00 10.4 4535 404.40 7.15 4 4.10 20.20 20.50 207 Est vol 40.071; vol Wed 37.660 open In 70.60.-31. . .... 407.35 + 4,10 97.10 1.00 121 CANADIAN DOLLAR (CME) - 100.000 din: 5 per Cans 31.01: vol Wed .. coen in 172.16. 12.54. June 7370 7000 736 70 0023.7600 494 8. Sept 736 7305 730 J7 000 10 10 7235 Words English (US) E E O Focus 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts