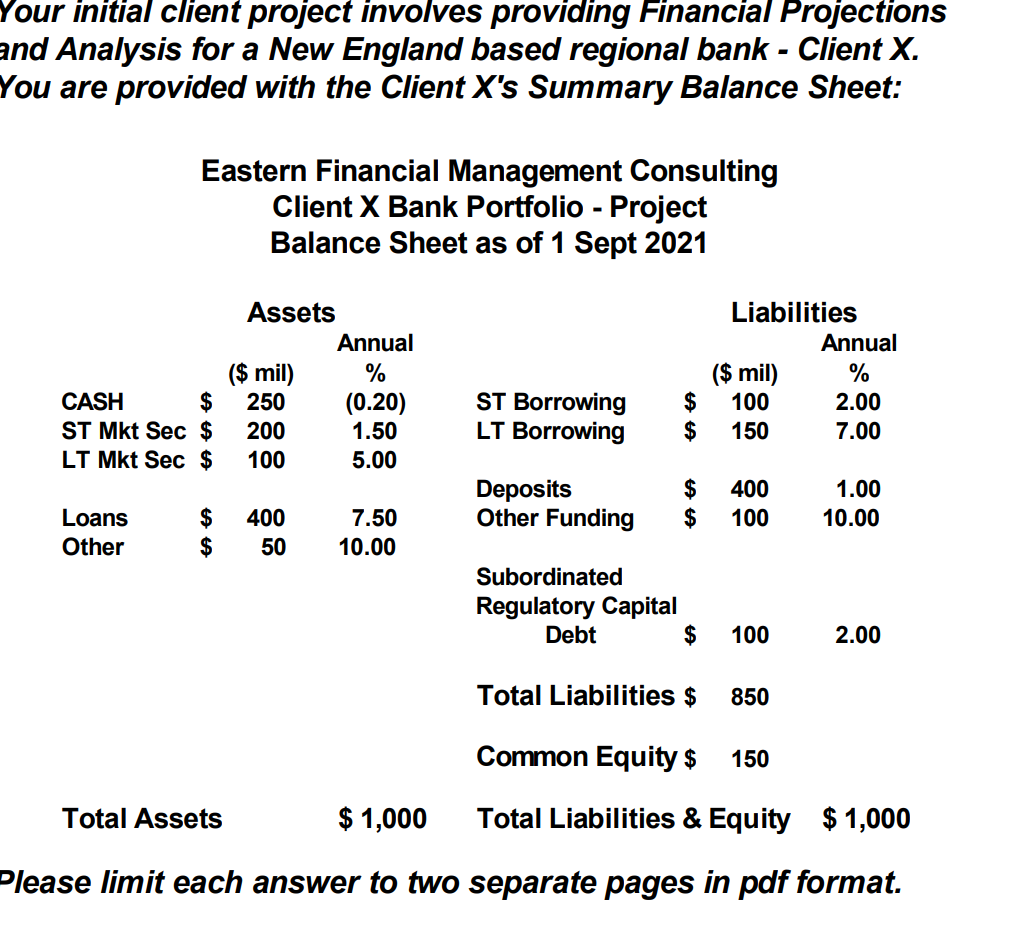

Question: Your initial client project involves providing Financial Projections and Analysis for a New England based regional bank - Client X. You are provided with the

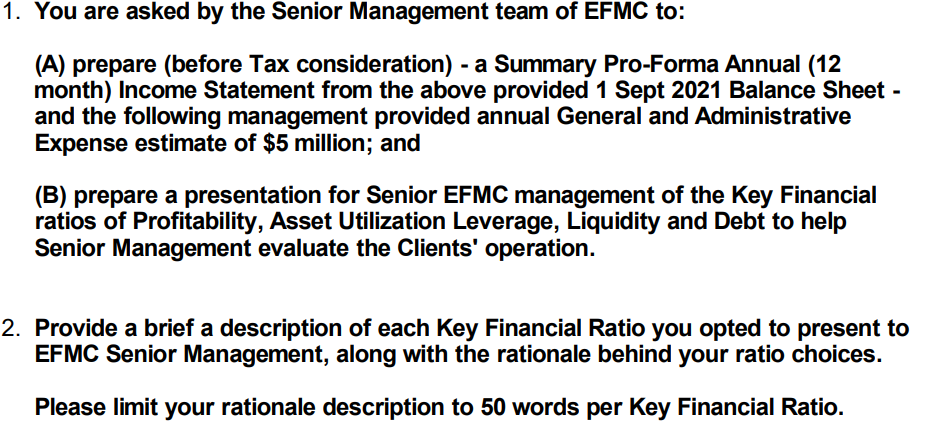

Your initial client project involves providing Financial Projections and Analysis for a New England based regional bank - Client X. You are provided with the Client X's Summary Balance Sheet: Eastern Financial Management Consulting Client X Bank Portfolio - Project Balance Sheet as of 1 Sept 2021 Assets Annual ($ mil) % 250 (0.20) 200 1.50 100 5.00 Liabilities Annual ($ mil) % 100 2.00 150 7.00 CASH $ ST Mkt Sec $ LT Mkt Sec $ ST Borrowing LT Borrowing $ $ Deposits Other Funding $ $ 400 100 1.00 10.00 Loans Other $ $ 400 50 7.50 10.00 Subordinated Regulatory Capital Debt $ 100 2.00 Total Liabilities $ 850 Common Equity $ 150 Total Assets $ 1,000 Total Liabilities & Equity $ 1,000 Please limit each answer to two separate pages in pdf format. 1. You are asked by the Senior Management team of EFMC to: (A) prepare (before Tax consideration) - a Summary Pro-Forma Annual (12 month) Income Statement from the above provided 1 Sept 2021 Balance Sheet - and the following management provided annual General and Administrative Expense estimate of $5 million; and (B) prepare a presentation for Senior EFMC management of the Key Financial ratios of Profitability, Asset Utilization Leverage, Liquidity and Debt to help Senior Management evaluate the Clients' operation. 2. Provide a brief a description of each Key Financial Ratio you opted to present to EFMC Senior Management, along with the rationale behind your ratio choices. Please limit your rationale description to 50 words per Key Financial Ratio. Your initial client project involves providing Financial Projections and Analysis for a New England based regional bank - Client X. You are provided with the Client X's Summary Balance Sheet: Eastern Financial Management Consulting Client X Bank Portfolio - Project Balance Sheet as of 1 Sept 2021 Assets Annual ($ mil) % 250 (0.20) 200 1.50 100 5.00 Liabilities Annual ($ mil) % 100 2.00 150 7.00 CASH $ ST Mkt Sec $ LT Mkt Sec $ ST Borrowing LT Borrowing $ $ Deposits Other Funding $ $ 400 100 1.00 10.00 Loans Other $ $ 400 50 7.50 10.00 Subordinated Regulatory Capital Debt $ 100 2.00 Total Liabilities $ 850 Common Equity $ 150 Total Assets $ 1,000 Total Liabilities & Equity $ 1,000 Please limit each answer to two separate pages in pdf format. 1. You are asked by the Senior Management team of EFMC to: (A) prepare (before Tax consideration) - a Summary Pro-Forma Annual (12 month) Income Statement from the above provided 1 Sept 2021 Balance Sheet - and the following management provided annual General and Administrative Expense estimate of $5 million; and (B) prepare a presentation for Senior EFMC management of the Key Financial ratios of Profitability, Asset Utilization Leverage, Liquidity and Debt to help Senior Management evaluate the Clients' operation. 2. Provide a brief a description of each Key Financial Ratio you opted to present to EFMC Senior Management, along with the rationale behind your ratio choices. Please limit your rationale description to 50 words per Key Financial Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts