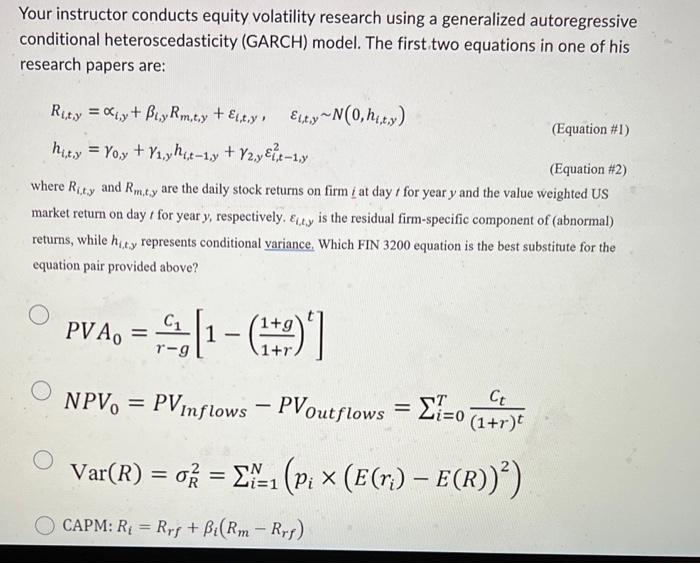

Question: Your instructor conducts equity volatility research using a generalized autoregressive conditional heteroscedasticity (GARCH) model. The first two equations in one of his research papers are:

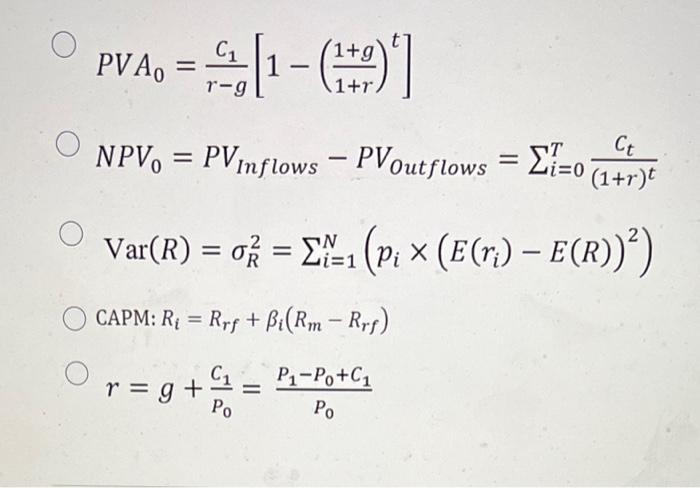

Your instructor conducts equity volatility research using a generalized autoregressive conditional heteroscedasticity (GARCH) model. The first two equations in one of his research papers are: Ri,t,y=i,y+i,yRm,t,y+i,t,y,i,t,yN(0,hi,t,y)hi,t,y=0,y+1,yhi,t1,y+2,yi,t1,y2 (Equation \#1) (Equation \#2) where Ri,t,y and Rm,ty are the daily stock returns on firm i at day t for year y and the value weighted US market return on day t for year y, respectively, i,t, is the residual firm-specific component of (abnormal) returns, while hi,t,y represents conditional variance. Which FIN 3200 equation is the best substitute for the equation pair provided above? PVA0=rgC1[1(1+r1+g)t]NPV0=PVInflowsPVOutflows=i=0T(1+r)tCtVar(R)=R2=i=1N(pi(E(ri)E(R))2)CAPM:Ri=Rrf+i(RmRrf) PVA0=rgC1[1(1+r1+g)t] NPV0=PVInflowsPVOutflows=i=0T(1+r)tCt Var(R)=R2=i=1N(pi(E(ri)E(R))2) CAPM:Ri=Rrf+i(RmRrf) r=g+P0C1=P0P1P0+C1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts