Question: Your local hardware store has a fixed asset turnover rate of 1.69 and a total asset turnover rate of 1.79. You notice that Home Depot

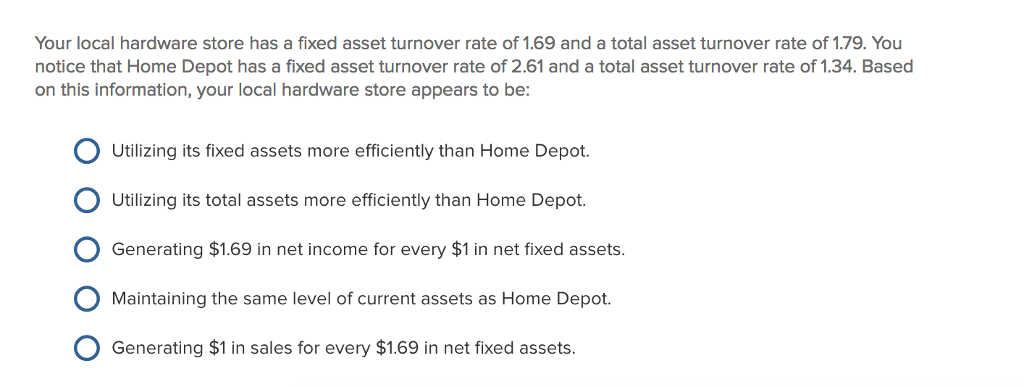

| Your local hardware store has a fixed asset turnover rate of 1.69 and a total asset turnover rate of 1.79. You notice that Home Depot has a fixed asset turnover rate of 2.61 and a total asset turnover rate of 1.34. Based on this information, your local hardware store appears to be:

|

Your local hardware store has a fixed asset turnover rate of 1.69 and a total asset turnover rate of 1.79. You notice that Home Depot has a fixed asset turnover rate of 2.61 and a total asset turnover rate of 1.34. Based on this information, your local hardware store appears to be: Utilizing its fixed assets more efficiently than Home Depot. Utilizing its total assets more efficiently than Home Depot. Generating $1.69 in net income for every $1 in net fixed assets. Maintaining the same level of current assets as Home Depot. Generating $1 in sales for every $1.69 in net fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts