Question: Your manager has asked you to analyse two stocks, X and Y. Stock X has an expected return of 17% and a beta of

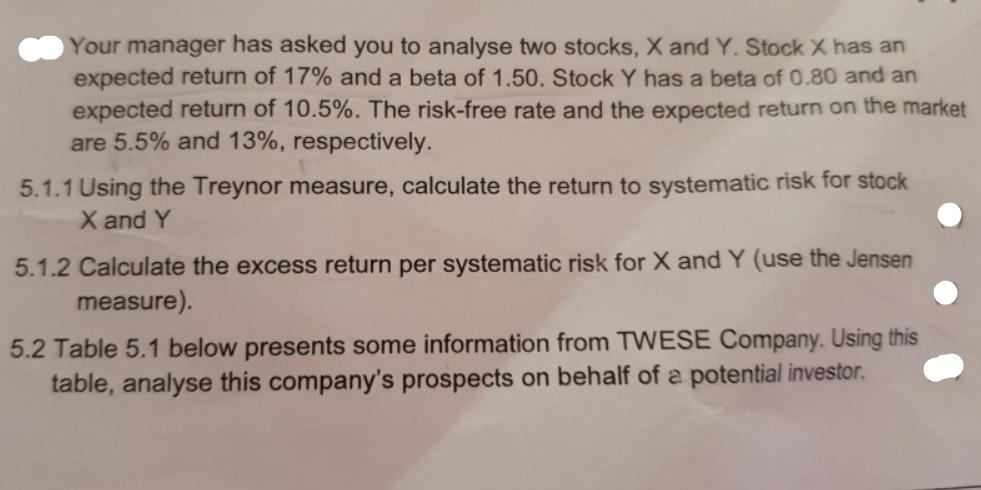

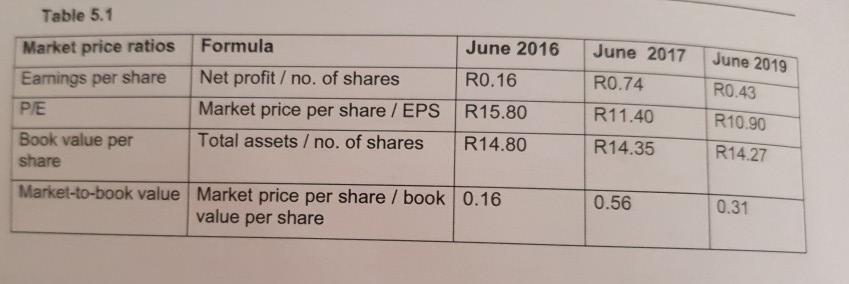

Your manager has asked you to analyse two stocks, X and Y. Stock X has an expected return of 17% and a beta of 1.50. Stock Y has a beta of 0.80 and an expected return of 10.5%. The risk-free rate and the expected return on the market are 5.5% and 13%, respectively. 5.1.1 Using the Treynor measure, calculate the return to systematic risk for stock X and Y 5.1.2 Calculate the excess return per systematic risk for X and Y (use the Jensen measure). 5.2 Table 5.1 below presents some information from TWESE Company. Using this table, analyse this company's prospects on behalf of a potential investor. Table 5.1 Market price ratios Earnings per share P/E Book value per share Formula Net profit/ no. of shares Market price per share / EPS Total assets / no. of shares June 2016 R0.16 R15.80 R14.80 Market-to-book value Market price per share / book 0.16 value per share June 2017 R0.74 R11.40 R14.35 0.56 June 2019 RO.43 R10.90 R14.27 0.31

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts