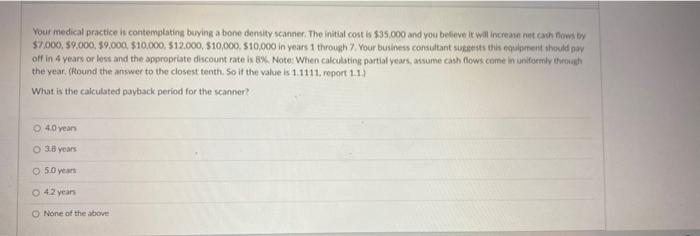

Question: Your medical practice is contemplating buving a bone density scanner. The initial cost is $35.000 and you believe it will increase net cash now by

Your medical practice is contemplating buving a bone density scanner. The initial cost is $35.000 and you believe it will increase net cash now by $7,000, 59.000, 59,000 $10,000, 512.000 $10,000, $10,000 in years 1 through your business consultant success the equipment should pa off in 4 years or less and the appropriate discount rate is 8% Note: When calculating partial years, assume cash flows come in uniformly twoch the year. (Round the answer to the closest tenth. So if the value is 11111. report 1:11 What is the calculated payback period for the scanner? O 40 years 3.8 years O 50 years 4.2 years None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts