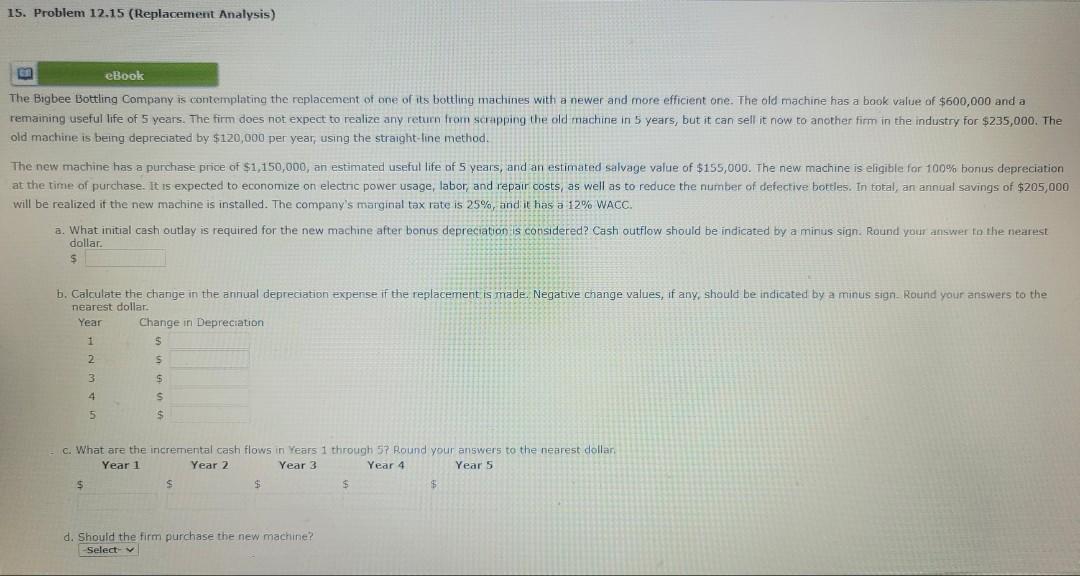

Question: your options are (accept) and (don't accept.) old machine is being depreciated by $120,000 per year, using the straight-line method. will be realized if the

your options are (accept) and (don't accept.)

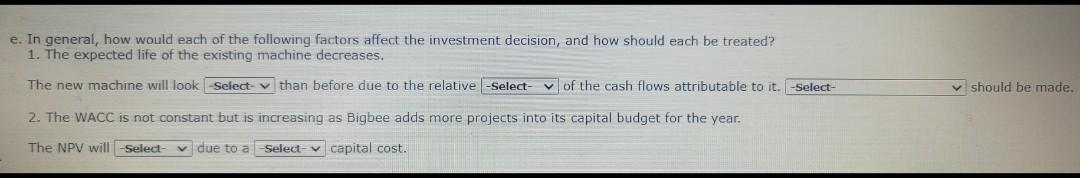

old machine is being depreciated by $120,000 per year, using the straight-line method. will be realized if the new machine is installed. The company's marginal tax rate is 25%, and it has a 12% WACC. dollar $ nearest dollar. c. What are the incremental cash flows in Years 1 through 5 ? Round your answers to the nearest dollar: d. Should the firm purchase the new machine? e. In general, how would each of the following factors affect the investment decision, and how should each be treated? 1. The expected life of the existing machine decreases. The new machine will look than before due to the relative of the cash flows attributable to it. should be made. 2. The WACC is not constant but is increasing as Bigbee adds more projects into its capital budget for the year. The NPV will due to a capital cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts