Question: . Your organization is trying to decide between two projects based on the Net Present Value (NPV). The NPV of Project A is $55,000 and

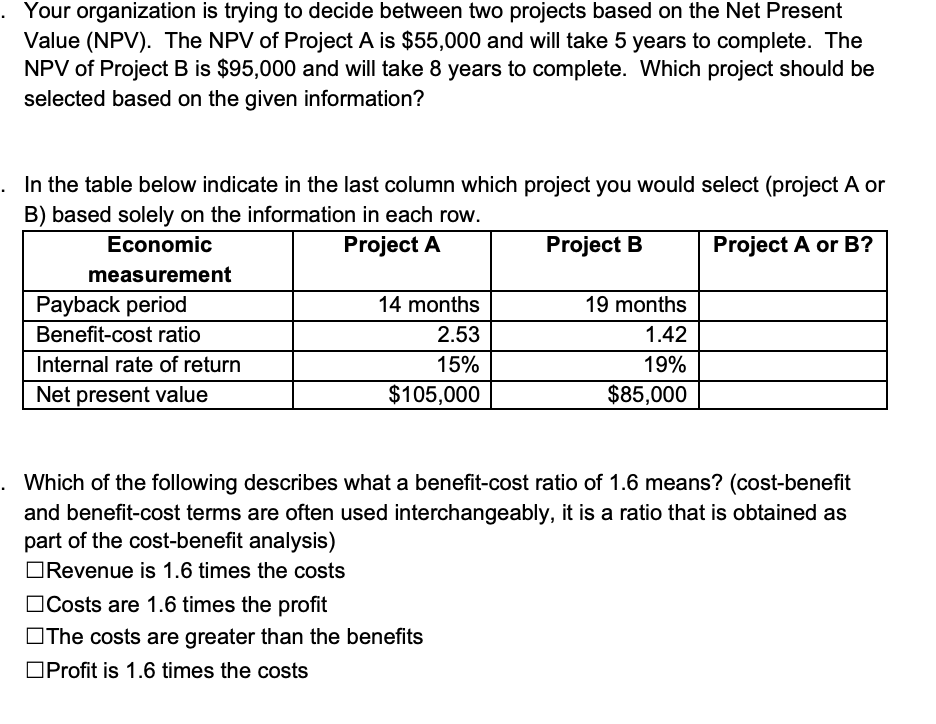

. Your organization is trying to decide between two projects based on the Net Present Value (NPV). The NPV of Project A is $55,000 and will take 5 years to complete. The NPV of Project B is $95,000 and will take 8 years to complete. Which project should be selected based on the given information? .In the table below indicate in the last column which project you would select (project A or B) based solely on the information in each row. Project B Economic Project A Project A or B? measurement Payback period 19 months 14 months Benefit-cost ratio 2.53 1.42 15% Internal rate of return 19% $105,000 $85,000 Net present value . Which of the following describes what a benefit-cost ratio of 1.6 means? (cost-benefit and benefit-cost terms are often used interchangeably, it is a ratio that is obtained as part of the cost-benefit analysis) ORevenue is 1.6 times the costs OCosts are 1.6 times the profit OThe costs are greater than the benefits OProfit is 1.6 times the costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts