Question: Your paper must: Be 4-6 pages in length. Include a proper introduction and conclusion. Include a reference page. Provide your reader with an overall understanding

Your paper must:

Be 4-6 pages in length.

Include a proper introduction and conclusion.

Include a reference page.

Provide your reader with an overall understanding of the financial health of your chosen firm including the following:

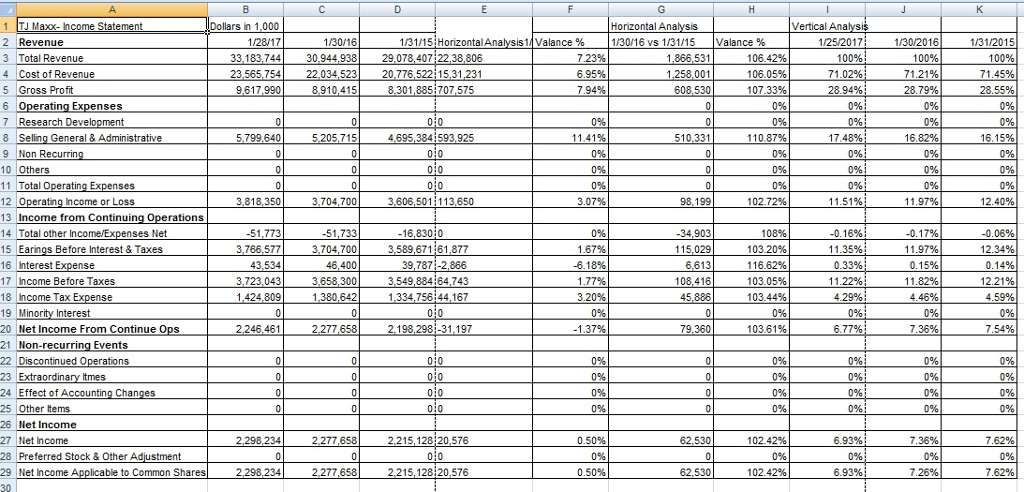

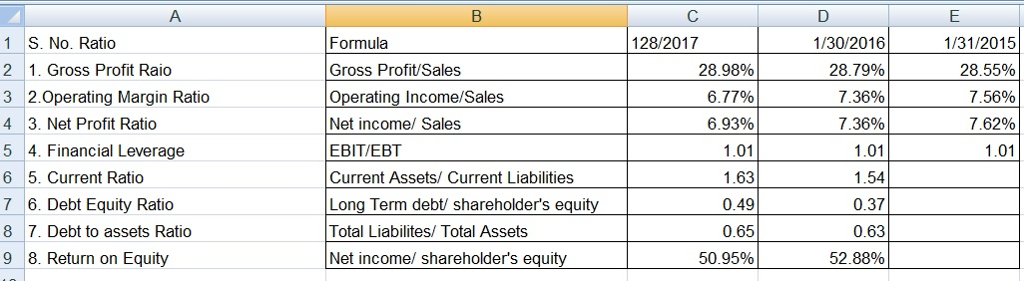

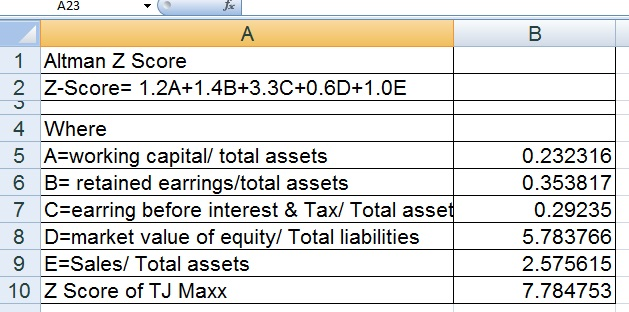

Discussion of the ratio analysis results, including rationale for the ratios chosen.

Discussion of all horizontal and vertical analysis from above.

Discussion of four items from the management discussion of the firm that support the conclusion formed in your discussion of the financial results.

Doesn't need to be the full paper, but need help answering those questions

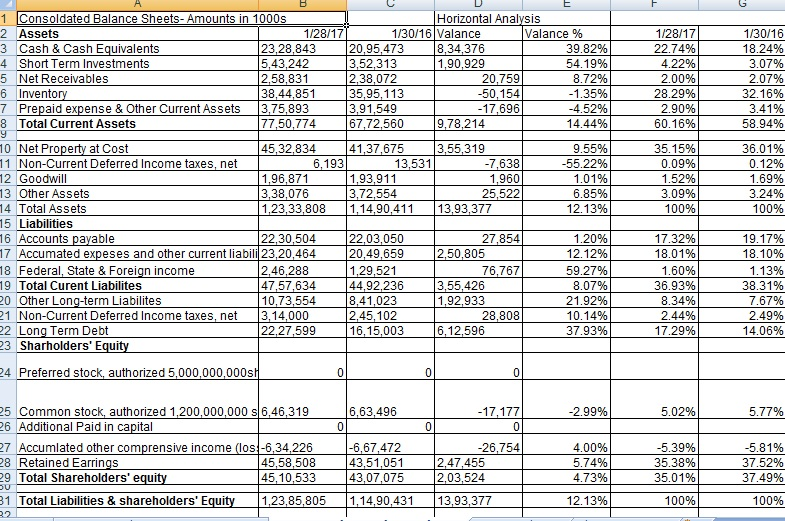

Horizontal Analysis 1 Consoldated Balance Sheets- Amounts in 1000s 2 Assets 3 Cash & Cash Equivalents 4 Short Term Investments 5 Net Receivables 6 Invento 7 Prepaid expense & Other Current Assets3,75,893 8 Total Current Assets 1/30/16 Valance Valance % 1/28/17 1/30/16 20,95,473 8,34,376 1,90,929 23,28,843 5,43,242 2,58,831 38,44,851 20.759 35,95,113 67,72,560 41,37,675 77,50,774 14.44% 3,55319 0 Net Property at Cost 11 Non-Current Deferred Income taxes, net 45,32,834 13,531 55.22% 25,522 3.24% 13 Other Assets 4 Total Assets 15 Liabilities 16 Accounts payable 7 Accumated expeses and other current liabii23,20,464 18 Federal, State & Foreign income 19 Total Curent Liabilites 0 Other Long-term Liabilites 21 Non-Current Deferred Income taxes, net 3,14,000 22 Long Term Debt 23 Sharholders' Equit 1,23,33,808 1,14,90,411 13,93,377 17.32% 19.17% 22,03,050 20,49,659 1,29,521 44,92,236 27854 12.12% 59.27% 2,46,288 76,767 3,55,426 1,92,933 21.92% 28,808 2,45,102 16,15,003 6,12,596 17.29% 24 Preferred stock, authorized 5,000,000,000s 17,177 2.99% 577% Common stock, authorized 1,200,000,000 S6,46,319 6 Additional Paid in capital 6,63,496 -5.81% 37.52% 6,67,472 7 Accumlated other comprensive income (los-6,34,226 28 Retained Earrings 29 Total Shareholders' equit 43,51,051 43,07,075 45,58,508 4 2,47,455 2,03,524 35.38% 35.01% 4.73% 1 Total Liabilities & shareholders' Equit 1,23,85,805 1,14,90,431 13,93,377

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts