Question: Your personal opinion is that a security has an expected rate of return of 0.12. It has a beta of 1.5. The risk-free rate is

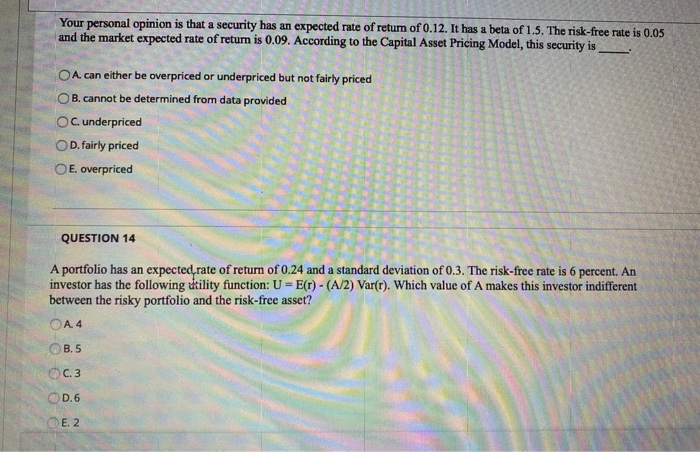

Your personal opinion is that a security has an expected rate of return of 0.12. It has a beta of 1.5. The risk-free rate is 0.05 and the market expected rate of return is 0.09. According to the Capital Asset Pricing Model, this security is A can either be overpriced or underpriced but not fairly priced OB. cannot be determined from data provided OC underpriced D. fairly priced E overpriced QUESTION 14 A portfolio has an expected rate of return of 0.24 and a standard deviation of 0.3. The risk-free rate is 6 percent. An investor has the following ukility function: U = E(r) - (A/2) Var(r). Which value of A makes this investor indifferent between the risky portfolio and the risk-free asset? OA. 4 B.5 0.3 OD.6 O E. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts