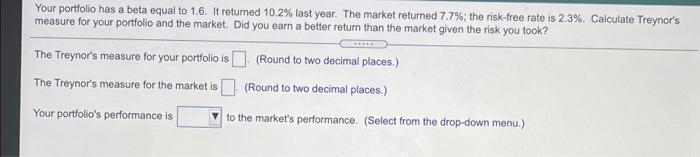

Question: Your portfolio has a beta equal to 1.6. It returned 10.2% last year. The market returned 7.7%; the risk-free rate is 2.3%. Calculate Treynor's measure

Your portfolio has a beta equal to 1.6. It returned 10.2% last year. The market returned 7.7%; the risk-free rate is 2.3%. Calculate Treynor's measure for your portfolio and the market. Did you earn a better return than the market given the risk you took? The Treynor's measure for your portfolio is (Round to two decimal places.) The Treynor's measure for the market is (Round to two decimal places.) Your portfolio's performance is V to the market's performance. (Select from the drop-down menu.) Your portfolio has a beta equal to 1.6. It returned 10.2% last year. The market returned 7.7%; the ri measure for your portfolio and the market. Did you earn a better return than the market given the ris The Treynor's measure for your portfolio is (Round to two decimal places.) The Treynor's measure for the market is (Round to two decimal places.) Your portfolio's performance is Photo to the market's performance. (Select from the drop-down equal superior inferior

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts