Question: Your problem may be completed on Word, Excel, or may be handwritten. Your file will be uploaded here for grading. The problem must be submitted

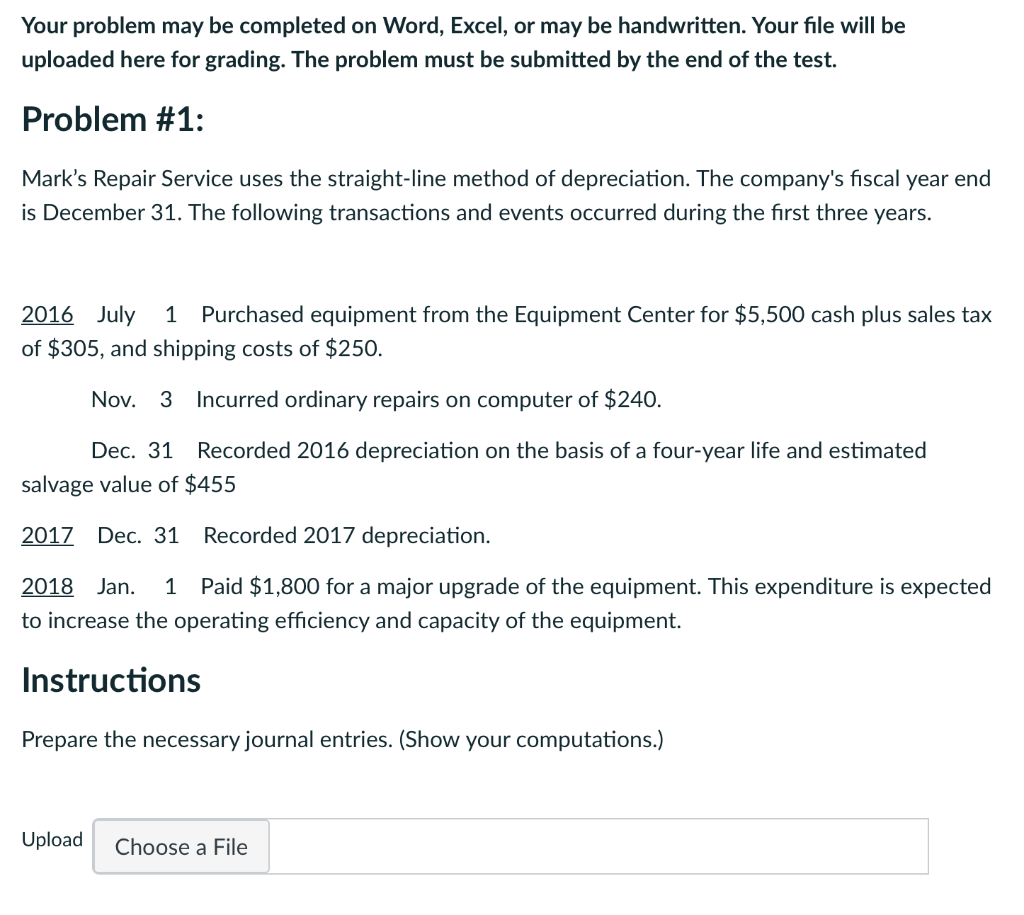

Your problem may be completed on Word, Excel, or may be handwritten. Your file will be uploaded here for grading. The problem must be submitted by the end of the test. Problem #1: Mark's Repair Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years. 2016 July 1 Purchased equipment from the Equipment Center for $5,500 cash plus sales tax of $305, and shipping costs of $250. Nov. 3 Incurred ordinary repairs on computer of $240. Dec. 31 Recorded 2016 depreciation on the basis of a four-year life and estimated salvage value of $455 2017 Dec. 31 Recorded 2017 depreciation. 2018 Jan. 1 Paid $1,800 for a major upgrade of the equipment. This expenditure is expected to increase the operating efficiency and capacity of the equipment. Instructions Prepare the necessary journal entries. (Show your computations.) Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts