Question: Your R&D division has just synthesized a material that will superconduct electricity at room temperature; you have given the go ahead to try to produce

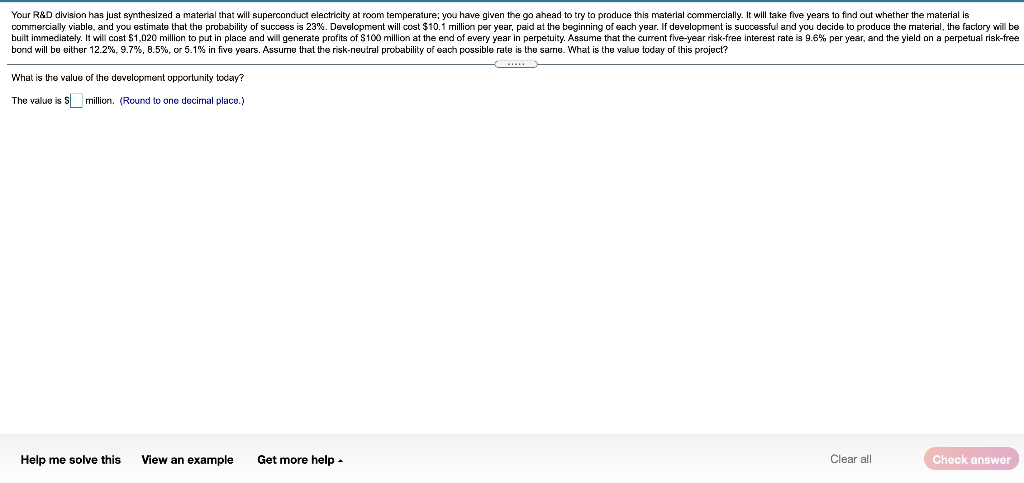

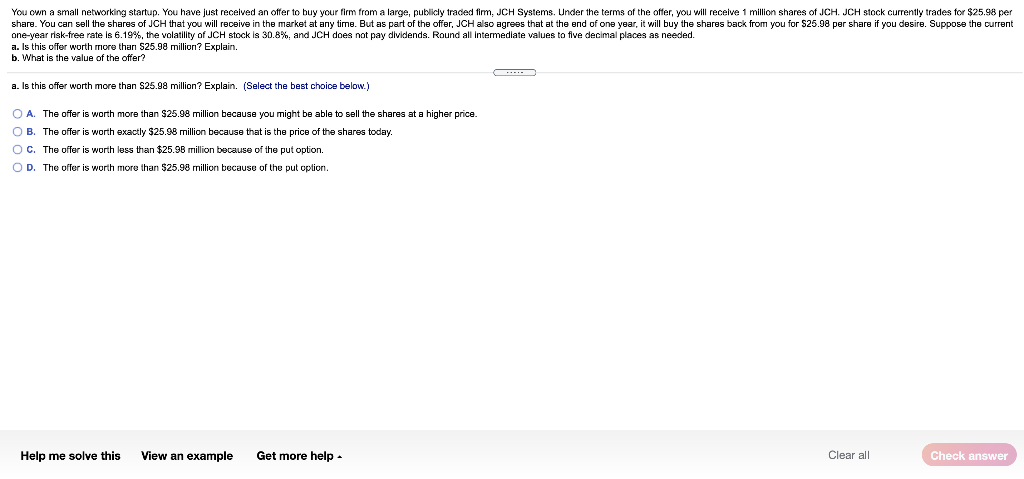

Your R&D division has just synthesized a material that will superconduct electricity at room temperature; you have given the go ahead to try to produce this material commercially. It will take five years to find out whether the material is commercially viable, and you estimate that the probability of success is 23%. Development will cost $10.1 million per year, paid at the beginning of each year. If development is successful and you decide to produce the material, the factory will be built immediately. It will cost $1,020 million to put in place and will generate profits of S100 million at the end of every year in perpetuity. Assume that the current five-year risk-free interest rate is 9.6% per year, and the yield on a perpetual risk-free bond will be either 12.2%, 9.7%, 8.5%, or 5.1% in five years. Assume that the risk-neutral probability of each possible rate is the same. What is the value today of this project? What is the value of the development opportunity today? The value is sl million. (Round to one decimal place.) Help me solve this View an example Get more help Clear all Check answer You own a small networking startup. You have just received an offer to buy your firm from a large, publicly traded firm, JCH Systems. Under the terms of the offer, you will receive 1 million shares of JCH. JCH stock currently trades for $25.98 per share. You can sell the shares of JCH that you will receive in the market at any time. But as part of the offer, JCH also agrees that at the end of one year, it will buy the shares back from you for $25.98 per share if you desire. Suppose the current one-year risk-free rate is 6.19%, the volatility of JCH stock is 30.8%, and JCH does not pay dividends. Round all Intermediate values to five decimal places as needed. a. Is this offer worth more than $25.98 million? Explain. b. What is the value of the e offer? a. Is this offer worth more than $25.98 million? Explain. (Select the best choice below.) O A. The offer is worth more than $25.98 million because you might be able to sell the shares at a higher price OB. The offer is worth exactly $25.98 million because that is the price of the shares today. O c. The offer is worth less than $25.98 million because of the put option. OD. The offer is worth more than $25.98 million because of the put option. Help me solve this View an example Get more help Clear all Check answer Your R&D division has just synthesized a material that will superconduct electricity at room temperature; you have given the go ahead to try to produce this material commercially. It will take five years to find out whether the material is commercially viable, and you estimate that the probability of success is 23%. Development will cost $10.1 million per year, paid at the beginning of each year. If development is successful and you decide to produce the material, the factory will be built immediately. It will cost $1,020 million to put in place and will generate profits of S100 million at the end of every year in perpetuity. Assume that the current five-year risk-free interest rate is 9.6% per year, and the yield on a perpetual risk-free bond will be either 12.2%, 9.7%, 8.5%, or 5.1% in five years. Assume that the risk-neutral probability of each possible rate is the same. What is the value today of this project? What is the value of the development opportunity today? The value is sl million. (Round to one decimal place.) Help me solve this View an example Get more help Clear all Check answer You own a small networking startup. You have just received an offer to buy your firm from a large, publicly traded firm, JCH Systems. Under the terms of the offer, you will receive 1 million shares of JCH. JCH stock currently trades for $25.98 per share. You can sell the shares of JCH that you will receive in the market at any time. But as part of the offer, JCH also agrees that at the end of one year, it will buy the shares back from you for $25.98 per share if you desire. Suppose the current one-year risk-free rate is 6.19%, the volatility of JCH stock is 30.8%, and JCH does not pay dividends. Round all Intermediate values to five decimal places as needed. a. Is this offer worth more than $25.98 million? Explain. b. What is the value of the e offer? a. Is this offer worth more than $25.98 million? Explain. (Select the best choice below.) O A. The offer is worth more than $25.98 million because you might be able to sell the shares at a higher price OB. The offer is worth exactly $25.98 million because that is the price of the shares today. O c. The offer is worth less than $25.98 million because of the put option. OD. The offer is worth more than $25.98 million because of the put option. Help me solve this View an example Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts