Question: Your task is to prepare and submit the following: (1) The two tax journal entries for the fiscal year ended August 31, 2023. Show your

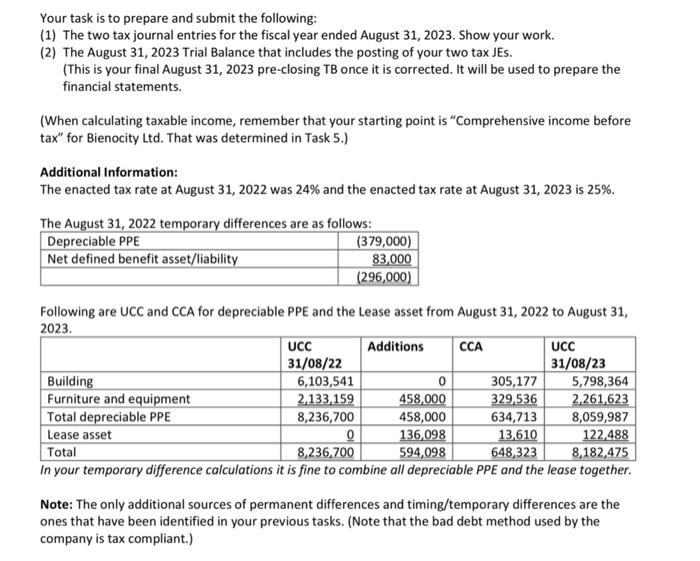

Your task is to prepare and submit the following: (1) The two tax journal entries for the fiscal year ended August 31, 2023. Show your work. (2) The August 31, 2023 Trial Balance that includes the posting of your two tax JEs. (This is your final August 31, 2023 pre-closing TB once it is corrected. It will be used to prepare the financial statements. (When calculating taxable income, remember that your starting point is "Comprehensive income before tax" for Bienocity Ltd. That was determined in Task 5.) Additional Information: The enacted tax rate at August 31, 2022 was 24% and the enacted tax rate at August 31, 2023 is 25%. The Aurust 31. 2022 temborarv differences are as follows: Following are UCC and CCA for depreciable PPE and the Lease asset from August 31, 2022 to August 31, 2023. In your temporary difference calculations it is fine to combine all depreciable PPE and the lease together. Note: The only additional sources of permanent differences and timing/temporary differences are the ones that have been identified in your previous tasks. (Note that the bad debt method used by the company is tax compliant.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts